KUWAIT: After its two-day policy meeting, the Federal Open Market Committee unanimously voted to maintain the federal funds rate between 1.00-1.25 percent and initiate the process of unwinding its balance sheet by October as anticipated by markets. The Fed has left its median projection for the Fed funds rate unchanged for 2017 and 2018. This indicates there is still room for one more hike this year and three more to come in 2018 despite the frequency of downside inflation figures the past six months. Markets currently expect a 60 percent chance of an increase in the FED's overnight rate for December and around 70 percent of FED officials support a rate hike in December. Overall, the Fed has been a lot more hawkish than the market for a long time. This theme therefore remains unchanged.

KUWAIT: After its two-day policy meeting, the Federal Open Market Committee unanimously voted to maintain the federal funds rate between 1.00-1.25 percent and initiate the process of unwinding its balance sheet by October as anticipated by markets. The Fed has left its median projection for the Fed funds rate unchanged for 2017 and 2018. This indicates there is still room for one more hike this year and three more to come in 2018 despite the frequency of downside inflation figures the past six months. Markets currently expect a 60 percent chance of an increase in the FED's overnight rate for December and around 70 percent of FED officials support a rate hike in December. Overall, the Fed has been a lot more hawkish than the market for a long time. This theme therefore remains unchanged.

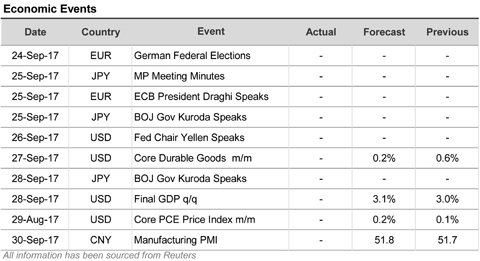

In Japan, the BoJ's monetary policy statement persisted in the same old theme as they choose to hold the overnight rate at negative 0.1 percent, 10-year Japanese government bonds around 0 percent and continue to purchase assets at around ¥80tn a year. The monetary committee also maintained its upbeat outlook for a solid recovery in the economy that will gradually accelerate inflation towards its 2 percent goal without additional stimulus. On the other hand, New board member Goushi Kataoka, who is a supporter of aggressive easing, diverged in an 8 to 1 vote and debated against the central bank's view that current policy was sufficient to boost inflation to its target.

On the currency front, the mixed momentum from the greenback disappeared on Wednesday after the Fed made formal announcement that it would begin tapering its balance sheet in October and the FED was more optimistic than markets predicted. The DXY gained strong ground against a basket of currencies, soaring 1.25 percent. The gains in the index were short lived as it fell back to the levels at the start of the week. The DXY began the week at 91.868 and closed on Friday at 92.221.

NBK Treasury Group Newsletter