Earnings per share 0.90 fils at 105% growth * Total revenues increased by 45%, reaching KD 27.184m

KUWAIT: Warba Bank, the best corporate bank and best investment bank in Kuwait, continues to achieve strong results realizing outstanding performance where the first quarter 2019 earnings recorded a remarkable growth, thanks to Allah blessings. Thus the Bank continues the growth march it has initiated in recent years.

With several achievements and successes in all areas of operation resulting in remarkable financial results accounting for the first quarter 2019 profit of KD 3.821 million or 31% increase compared to KD 2.917 million for the same period in 2018. the total revenues achieved as a result of the outstanding performance of all business sectors reached KD 27.184 million or at an increase of 45 percent compared to the same period last year. The operational revenues increased at a gross rate of 31 percent recording KD 14.226 million by 31 March 2019 compared to KD 10.880 million for the same period 2018.

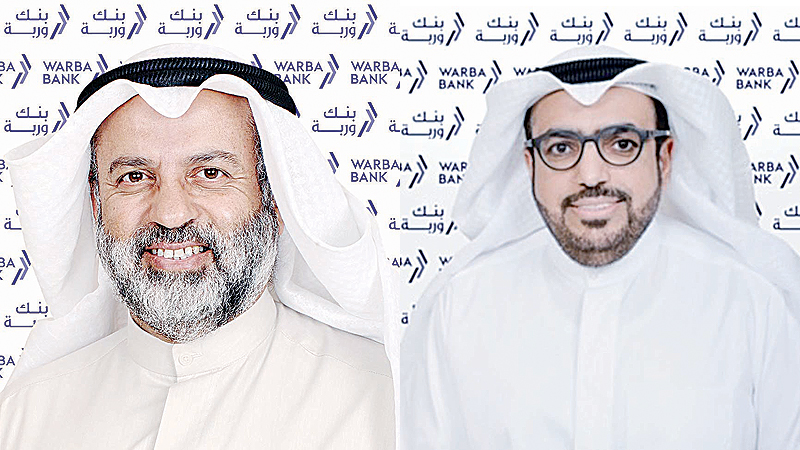

Commenting on the Bank results for the first quarter 2019, Abdul Wahab Abdullah Al-Houti, Warba Bank Chairman said: "By Allah blessings, Warba Bank results in the first quarter 2019 complements its achievements in 2018, which the Banks has built upon towards achieving further growth and successes. Today, Warba Bank is investing in its growth, expansion and banking operations at all levels. The profits reflect the Bank's development strategy, expansion and financing plans to diversify its profit resources, avoid risks, rationalize spending and increase operating income from its core banking activities to ensure sustainable development and profitability which confirm performance integrity in-light of the Bank commitment to its investment and financing policy and effective risk management according to best practices in this field.

"The growth witnessed by Warba Bank today in terms of the customer demand on the Bank's services both from retail and corporate, is a strong indicator of its position as a champion in the Islamic banking sector being a modern Islamic banking institution that keeps abreast of the technological developments and is working to implement them in its banking services and products".

Al-Houti stressed that Warba insists on championing the digital banking sector and injecting necessary investments in this field to develop digital banking solutions that keep pace with growth in the global banking sector while meeting the aspirations of customers looking for flexible, fast and secure digital banking services especially in terms of the financing services heavily visited by customers at high demand submitting financing applications through, "Warba Online", which saves time and effort; by filling in a an application form, the customer can realize his/her entitlement to get financing and will then be contacted by our specialist team till the service is accomplished.

Al-Houti concluded; "During the past period, we have been able to honor our promises to our customers and, thankfully, we have been able to differentiate them with a range of exclusive banking services and solutions that have contributed to the enrichment of this fast growing sector."

The Bank's total assets increased due to its expansion strategy in the local and regional markets and investment in high quality low risk assets amounting to KD 2.593 billion, while the financing portfolio witnessed a remarkable growth of KD 1.762 billion, an increase of 29 percent compared to 31 March 2018. As a result of the high quality of the financing portfolio, the Bank's non-performing financing ratio was 1.68 percent at the end of the first quarter this year.

Shaheen Hamad Alghanem, Warba Bank Chief Executive Officer , said that the Bank achieved outstanding results in the first quarter. He stressed that the Bank's current approach is to participate in financing mega economic projects in the Kuwait and overseas confirming that it is a high important strategy to the Bank's business for supporting development efforts.

He pointed out that in 2019, Warba Bank will continue to finance Kuwaiti companies, help them develop their business and implement their expansion plans. Small and medium enterprises will be given greater importance, in line with the Bank's belief in supporting the youth business and developing the entrepreneurs' performance which would contribute in income diversification while providing more employment opportunities and building national experiences in business. He stressed that the 50 percent capital increase in December 2018 is the main platform for developing the Bank's medium-term operations and enhancing its financing contributions in viable projects that secure sustainable returns, support corporate sector. The capital increase has also helped injecting needed investments in developing the Bank's digital infrastructure and geographical expansion throughout Kuwait.

Warba Bank performance in Q1, 2019

Since the beginning of this year, Warba Bank has been developing its financing solutions to cover new sectors. After scoring several achievements in providing financing for sectors such as health care, auto and building materials, the Bank expanded its efforts and entered a new sector to secure its financial services, that is medical treatment at medical institutions abroad after signing an agreement with " Travel Market" the associate of Boodai Aviation Group. To get a medical treatment financing, the Bank provides two methods: The first is to deposit the treatment amount in the form of Al-Sunbula deposit at Warba Bank for a specified period of time with a return of up to 3 percent whereas the customer will have the opportunity to enter and win in the weekly and quarterly Al-Sunbula draws throughout the deposit period. The second method is to apply for direct financing from Warba Bank without any profits on the required amount of not exceeding KD25 with a flexible instalment period up to five years.

Moreover, the Bank added a unique service to its financing portfolio offering the opportunity to obtain personal finance to purchase building materials smoothly by following easy steps on smart devices through the Bank's partnership with Banaa.com, the company specialized in providing best offers and alternatives on all building materials.

In the first quarter, Warba Bank enhanced its auto financing program under the slogan: "Installment at Cash Price" without a down payment and 0 percent profit over 5 years, which has attracted customers and non-customers at a big demand. The Bank signed an agreement with Al-Zayani Group, the exclusive agent in Kuwait For Maserati's Italian-made cars, to provide financing for the purchase of the magnificent Maserati cars, including: Maserati Levante, Maserati Gibley and Maserati Quattour Porte.

The Bank also participated for the second year in row, at the Auto Show, held last March at the Marina Crescent with participation of many agencies of international brands. A team from Warba Bank presented financing solutions for those wishing to purchase cars.

Al-Sunbula Account & Deposit

Due to the increasing demand witnessed by Al-Sunbula account from Warba Bank, the Bank worked in early 2019 to develop the account and deposit in a new and sophisticated way. The developments included an increase in the number of draws, becoming weekly with five winners each getting an amount of KD 1,000 and the Mega Draws, held every quarter awarding five winners, with cash prizes and Land Cruiser VXR.

In terms of upgrades to the Al-Sunbula deposit, the Bank has increased the expected rate of return to the customer to reach 3.5 percent when depositing KD 100,000 and above for 3 years - which is the highest rate in the Kuwaiti banking sector with returns disbursed monthly or at deposit maturity as per customer's choice. The deposit also gives customers the opportunity to enter the weekly and quarterly Al-Sunbula draws for every 1000 Kuwaiti Dinars as well as access to other special services.

Warba…Socially responsible.

Warba Bank Corporate Social Responsibility Calendar in 2018 has been full so rich. It includes organizing and sponsoring a number of social events aimed at various segments of society. In 2019, the Bank continues in implementing its leading corporate social responsibility program based on supporting various segments of society in different fields; notably culture, education and the health sector. In the first quarter this year, Warba Bank strengthened its strategic partnership with the Super Kick Academy, which was held earlier this year, by launching a promotional campaign for users of Fayez App, the Bank's sport application offering them great discounts when they register their children at the Academy.

Under this partnership, parents can get discounts starting at 5 percent on the Academy's registration fees by redeeming the points they collected when using the Fayez App. The greater the number of steps taken and calculated by the application, the higher the discount rate reaching maximum 25 percent. Application users are entitled to redeem Points to receive a one-time discount at a monthly rate. It's noteworthy that Fayez", has made a strategic turn in educating the Kuwait society on the importance of sports and maintaining a healthy lifestyle.

For spreading its cultural and educational role about Islamic banking among young people, Warba Bank organized a recreational activity for Tala account customers, aged 14 years and younger at Trambo Xtreme in Morouj complex offering them free tickets to enjoy the Trambo Games, and gifts. The Bank's team was keen to be present at the event through a special corner where it provided all necessary information about Tala's investment account for children, which is based on the principles of Islamic Shari'a, and aims at educating young generation about the importance of savings from an early age.

Warba Bank also participated in the open day event organized by the Civil Aviation Administration for its employees at its premises at Kuwait International Airport. A team from Warba Bank has provided staff with a full explanation of the Bank's products; flexible financing offers and solutions that suit all needs as well the Bank's marketing campaigns.

Winning awards

Warba Bank has harvested a number of local and regional awards in the first quarter this year. In terms of banking operations, the Bank received the "Elite Quality Recognition 2018" Award from GE. B. Morgan Chase 2018:, for the quality of operations in both categories after achieving high ratios in direct operations (STP) for the transfer of funds amounted to 99.0 percent in the classification MT103 and 99.7 percent in the classification of MT202 .The award came in recognition of the Bank success to maintain a distinct level of services and processes offered throughout the year in the field of electronic transfer in USD. As well, the Bank won two prestigious awards from IFN magazine: "Structured Finance Deal of the Year" for completion of the first sukuk transaction related to financing aviation sector Sharia compliant (Shaheen SPV) and "Cross Border Deal of the Year" for leading a syndicated financing arrangement of Byrne Equipment Rental LLC with the value of $ 91 million.

On local level, and during the "Creative Advertising" event, Warba Bank won "Marketing & Media Communication Fast Growth Excellence "' Award for given the bank's strong excellence and strong presence on both media and advertisement levels in 2018. The award reflected the great and intensive efforts exerted by the Bank's team throughout 2018 to communicate with the Kuwaiti society through all media channels including print, audio and visual.

The Bank has sponsored the "Loans, Bonds & Sukuk Middle East 2019" conference, the largest in the region in the banking in the Middle East, bringing together Sukuk issuers, investors and bankers to discuss the latest developments in the local and international debt markets; the conference has formed an excellent platform for Warba Bank to communicate with stakeholders and discuss future cooperation opportunities.