KUWAIT: Oil prices showed signs of recovery from a 22-year low level towards the end of April-2020 after reports suggested a demand revival expected during the second half of year. Prices were also supported by extreme supply curbs implemented by OPEC producers, primarily Saudi Arabia, as well as a price-led decline in production seen in US shale patch. Moreover, the storage crunch-led price crash in the futures market that saw negative near month futures for the first time on record also eased led by increasing refinery runs and surprise stock drawdowns in the US.

In terms of oil demand, expectations for 2H-2020 remains unclear but estimates for Q2-2020 shows a y-o-y decline of around 20 percent in global oil demand, one of the biggest declines on record. That said, the estimates for the year have been revised positively from last month. As per the IEA, world oil demand is expected to improve to 91.2 mb/d in 2020 vs. previous expectation of 90.5 mb/d, which now represents a y-o-y decline of 8.6 mb/d. Moreover, the opening up of 23 states in the US that account for 40 percent of oil demand is expected to stabilize oil prices. In addition, India’s oil demand is expected to increase by 20 percent or 0.65 mb/d in May-2020 after witnessing the worst monthly sales in more than 12 years. The increase is expected to be driven by the start of the planting season that results in higher diesel requirements.

Meanwhile, a new trend in China, which has restarted its economy, has seen a preference to use personal transport instead of public transport as a way of protection from the virus. This could see a higher than expected increase in oil demand in the near term and higher demand for gasoline. Traffic data for major cities also show congestions that were higher than the pre-pandemic levels. Also, refineries in China have ramped up operation recently recording a m-o-m increase of 11 percent during April-2020 marking a recovery from a 15-month low throughput. Higher margins due to the fall in crude prices has also prompted independent refiners in China, called ‘tea pots’, to ramp up production.

The recent rally in oil price was mainly led by supply cuts announced by OPEC and a fall in output from other producers as demand growth remained largely uncertain and was marred with downside risks.

Saudi Arabia has pledged to reduce supply to the lowest in 18 years in June-2020, in addition to further cuts from other OPEC members including Kuwait, UAE, Iraq and Nigeria. Output from the non-OPEC group has declined at a faster-than-expected rate. According to IEA, non-OPEC production was down by 1.1 mb/d in April-2020 crude with Q2-2020 production expected to fall by 6.7 mb/d. The US is expected to see the biggest drop in output, according to the agency, with May-2020 production expected to decline by 1.2 mb/d which would further deepen to 2.8 mb/d by the end of the year. According to Baker Hughes, total world oil and gas rotary rig count declined by a cumulative 29 percent or 611 rigs in March and April-2020.

Oil prices

Spot crude prices traded at 6-week high levels reaching $23.3/b during the second week of May-2020 after trading below the $20/b mark for most part of April-2020. The surge was led by expectations of recovering demand in the near-term as well as announcements of steeper curbs in supplies across the globe. A decline in US crude inventories by 745 thousand barrels during the week ended 8-May-2020 also pushed prices up in the oil market. This was the first weekly decline in US crude inventories after increasing consecutively for the previous 15 weeks that saw a buildup of more than 100 million barrels in crude stocks. Nevertheless, despite the recent surge, crude prices have declined 66 percent since the start of the year. The average Brent crude prices during April-20 were the lowest since July-1999 at $18.47/b, a m-o-m decline for the third consecutive month by 42 percent. This was also one of the steepest declines in average crude prices on record. OPEC crude spot declined at a faster pace of 48 percent to average at $17.66/b while Kuwait crude averaged at $18.76/b after registering a decline of 46.6 percent from the previous month.

The consensus estimates for crude prices for the year continued to get downgraded over the last few weeks. EIA expects Brent to average at $34/b in 2020, a slight revision from last month’s estimate of $33/b. The median estimate for Brent crude, according to Bloomberg, was at $37.8/b for 2020, $4.2/b lower than its previous forecast of $42/b last month. Prices are expected to gradually increase to $50.5/b in 2021. The price revisions come as a response to recovering demand and lowering supplies globally.

The US has seen one of the steepest downward revisions in its crude production forecasts. According to latest weekly rig count report from Baker Hughes, the US showed its ninth consecutive weekly decline in oil rig count. Oil rigs in the US declined by 34 last week to reach 258 rigs, the lowest level of oil rig count since July-2009. The number of rotary oil rigs in the US has declined by 425 over the last nine weeks and by more than two-thirds or 544 oil rigs over the last one year. This was reflected in the decline in crude production in the US that dropped to 11.6 mb/d last week as compared to a record level of 13.1 mb/d in March-2020. Weekly DOE data for the US has shown seven consecutive weeks of production decline aggregating to 1.5 mb/d until the week ended 8-May-2020. The steep pace of fall in crude production also came as a result of brimming crude oil storage facilities in the US.

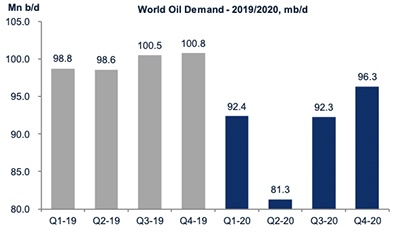

World oil demand

World oil demand growth estimates for 2019 remained unchanged at 0.83 mb/d to an average of 99.67 mb/d during the year. For 2020, demand growth expectations were further lowered in the latest assessment by 2.23 mb/d and is now expected to decline by 9.07 mb/d to average at 90.59 mb/d during the year. The lowered estimates primarily reflected a steep fall in demand for transportation fuels during Q2-2020 led by the Covid-19 lockdowns with further weakness expected in demand for industrial fuels. Demand from OECD countries was revised lower by 1.20 mb/d to 42.71 mb/d, whereas non-OECD oil demand growth was adjusted down by 1.03 mb/d.

World oil supply

World liquids production declined by 0.18 mb/d during April-2020 to average at 99.46 mb/d mainly led by a fall in production in the US, Canada, Ecuador, Brazil and Kazakhstan that was partially offset by higher production by OPEC producers. As a result, the share of OPEC crude in total global production increased by 190 bps to 30.6 percent during April-2020.

Non-OPEC oil supply growth estimates for 2019 was revised up marginally by 0.04 mb/d from previous estimate reflecting an upward revision in Australia’s production data. Supply in 2019 is estimated to have grown by 2.02 mb/d to average at 65.03 mb/d. Non-OPEC oil supply in 2020 was further lowered by almost 2.0 mb/d from the previous forecast. Supply in 2020 is now forecasted to decline by 3.5 mb/d to average at 61.5 mb/d during the year. The revisions reflected decline in supply coming primarily from the US, Russia and Canada totaling 3.16 mb/d further supported by decline in production in Kazakhstan, Oman, Azerbaijan, Malaysia and Mexico.

OPEC oil production & spare capacity

OPEC crude production witnessed one of the steepest growth in recent months in April-2020 after the initial disagreement over supply curbs led to higher output by most members of the group, primarily Saudi Arabia. Bloomberg data showed OPEC production increasing to the highest in 14 months to reach 30.36 mb/d after increasing by 1.73 mb/d as compared to March-2020. OPEC secondary sources showed an almost similar production level of 30.41 mb/d with a monthly increase of 1.8 mb/d. The increase came primarily on the back of higher production in Saudi Arabia, UAE and Kuwait that reported an aggregate increase of 1.84 mb/d, according to Bloomberg.

Production in Saudi Arabia averaged at 11.4 mb/d during the month, the highest rate of production on record by the Kingdom. The production rate of UAE at 3.72 mb/d was also the highest on record by the country. The agreed upon cuts of around 9.7 mb/d by the 23 producers of OPEC+ is said to be swiftly implemented and according to reports from traders, the cuts are even deeper than the agreed upon quotas. Bloomberg’s tanker tracking data showed that Saudi Arabia and reduced exports by around 2.6 mb/d or 28 percent to 6.7 mb/d during the first two weeks of May-2020. Exports in June-2020 will also be slashed to the Kingdom’s customers in Asia, US and Europe, a move that will be followed by Kuwait, UAE and Oman. Saudi Arabia’s commitment to cut production by an additional 1 mb/d in June will push its output down to the lowest since 2002. Reports have also shown output being curbed by Russia at a surprisingly fast pace. Official data has shown production in Russia has already fallen to 8.75 mb/d, close to its commitment of 8.5 mb/d.