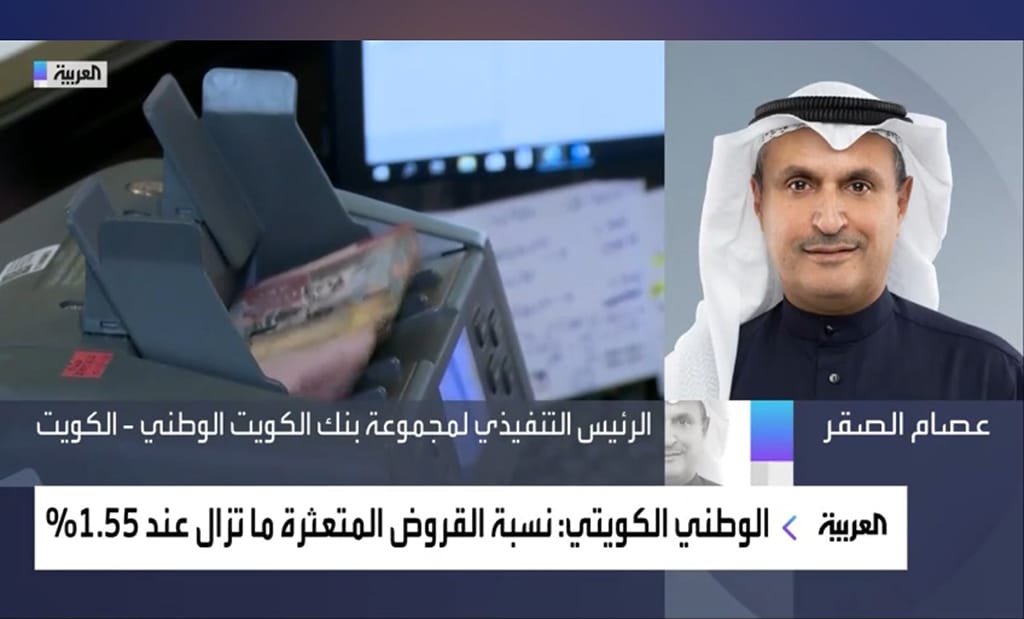

KUWAIT: Isam J Al-Sager, Group Vice-Chairman and CEO of National Bank of Kuwait (NBK) said that in the first quarter of 2023, the bank succeeded in sustaining the exceptional performance in 2022 by maintaining improved operational activities, robust asset growth, increased liquidity levels, and solid capital base. In his interview with Al-Arabiya TV to comment on the Group’s results for the first quarter of 2023, Al-Sager mentioned: "The Group’s operating revenues rose by over 18.4 percent year-on-year, which was a key driver of boosting net profit, supported by the robust growth of net interest income by 26 percent and fees and commissions income by 19 percent.”

"With the support of our solid financial position, strong capitalization rates, and ample liquidity levels, we are positioned for sustained earnings growth during the remainder of 2023,” he added. Conservative approach Commenting on the increase in provisions during the first quarter, Al-Sager explained that NBK historically follows a prudent policy with regard to provisions, noting that in the first quarter, the Group continued to follow a conservative approach in managing its credit exposures, taking into account the extended impact of a number of different factors in the markets where we operate. "Despite of the global uncertainty, we are optimistic that the cost of risk will remain at healthy levels in 2023, thanks to our strong asset quality levels,” he added.

"I would like also to accentuate that our diversified business model, strong financial position, ample liquidity levels, and constant focus on risk management enable us to overcome any potential challenges that may be imposed by global developments,” he elaborated. Stringent banking supervision On the possibility of a spillover effect from the crises in the US banking sector and Credit Suisse to the Kuwaiti banking sector, Al-Sager mentioned that this crisis is unlikely to extend to Kuwait, as the Central Bank of Kuwait is considered one of the most conservative regulators, thanks to following an approach that proved efficiency in the face of many historical crises.

"Kuwait has stringent regulatory requirements that are even ahead of international best practices (Basel and IFRS requirements), which remain rigorous under most stress testing scenarios. Kuwaiti banks are also strictly and carefully regulated by the Central Bank of Kuwait, regardless of their size or systemic importance, limiting any collective repercussions (domino effect) in the event of a crisis,” he highlighted. "The Kuwaiti banking sector enjoys strong liquidity and capitalization, with capital adequacy ratio ahead of regulatory requirements, as well as low NPL ratios coupled with high credit loss provisions,” he mentioned.

Secure portfolio With regard to the possibility of Group’s investment portfolio being impacted by global repercussions, Al-Sager said that the Group’s investment portfolio is very conservatively structured with high quality exposures and very limited risks. "Around 60 percent of the investment portfolio is in government securities largely in the GCC, whereas around 80 percent of the Group’s investment securities portfolio comprise of investments, which are carried at fair value. The remaining smaller portion is regularly assessed and its carrying values are not materially different from their fair values,” he elaborated.

"We also have a sizable base of that portfolio are classified as HQLA, that can be sold or reposed for cash if the need arises. And the interest rate risk on those bonds is hedged via interest rate swaps. So we have no concern of any material spillover effect from the events in the US banking sector,” he added. Diversification offering protection On the devaluation of the Egyptian Pound and its impact on the bank’s performance in Egypt, Al-Sager said: "The devaluation of the Egyptian pound adversely affects NBK-Egypt’s profits denominated in US dollar in the Group’s consolidated balance sheet. However, its contribution to the Group’s profits is not substantial, in light of our geographically diversified income sources.”

Al-Sager stressed that NBK has long-term investments in Egypt, and that the devaluation of the Egyptian pound and soaring inflation are seen as exceptional circumstances that many emerging markets around the world are witnessing at the present time. "We are planning for further expansion in the retail sector, in which we see growth opportunities, given the large population and the increasing rate of financial inclusion, basically through increasing our investments in digital banking services,” he noted.