OPEC+ compliance off to a sluggish start

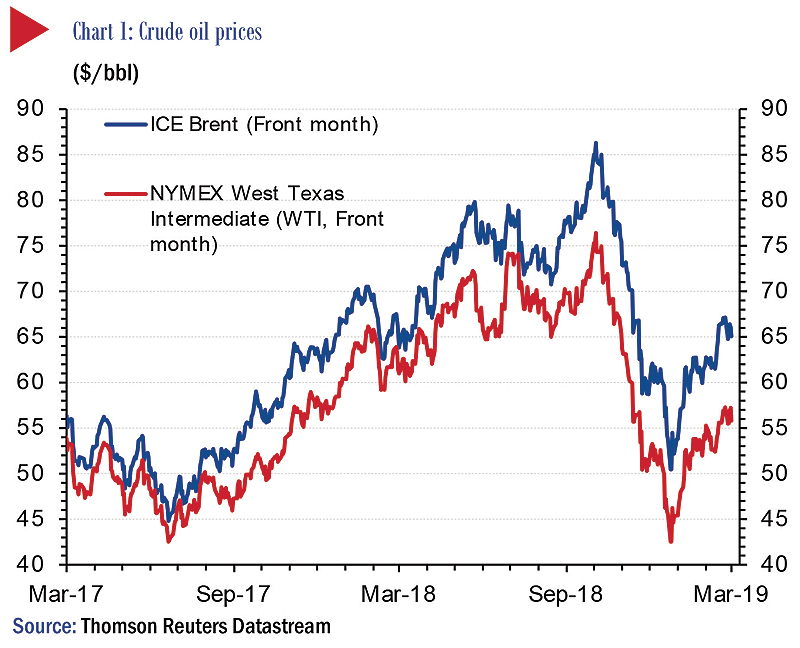

KUWAIT: Almost two months into the New Year and oil prices have staged a remarkable turnaround, recovering nearly half of their losses from the last quarter of 2018, when prices dropped by almost 35 percent. Brent crude, the international oil benchmark, is up by around 21 percent so far in 2019 at $65.1/bbl, having posted in January its best monthly return in almost three years. Its light US crude counterpart, West Texas Intermediate (WTI), has gained almost 23 percent year-to-date to top $55/bbl.

Prices have been riding a crest of bullish sentiment since late December, centered largely but not exclusively on the expressed commitment of OPEC and its Vienna agreement partners to drain excess supplies from the market.

Geopolitical risk factors have also come into play on the supply side. The imposition of US sanctions on Venezuela in January, added to the impending expiry of the 180-day US sanctions waivers on Iran in May and crude rationing in Canada due to pipeline bottlenecks, has helped feed into the narrative of tightening crude markets, especially in heavy sour crude.

On the oil demand side, the outlook over the next six to twelve months is also supportive. The International Energy Agency (IEA) expects global oil demand in 2019 to increase by 1.4 mb/d to 100.6 mb/d. This compares with 2018's increase of 1.3 mb/d. In its forecast, the IEA cites the start-up of petrochemical projects in the US and China and the lower oil prices of 4Q18 as being positive for oil demand growth. Colder temperatures in the northern hemisphere winter (heating oil) are also bound to be supportive, at least in 1Q19.

The relatively healthy oil demand outlook comes despite projections of weaker global economic growth this year by the International Monetary Fund (IMF). The Fund recently lowered its estimate of global growth for 2019 by 0.2 percent to 3.5 percent on softer Eurozone and China output, tighter monetary conditions and potentially deteriorating China-US trade relations. On the latter, oil markets appear to be currently adopting a less alarmist attitude, however, although given the ebb and flow of these trade discussions, tensions could come to the fore at any time.

The change in the outlook is especially evident in the futures market, where over the last two months, the Brent futures curve has flipped from a contango structure, in which near-term (or spot) prices for delivery of crude oil are lower than prices for delivery further out, to the opposite, backward-dated structure. Here, prices for immediate delivery (M1) are higher than prices for delivery in twelve months (M12), for example, a sign that markets are getting tighter.

Hedge funds and speculators are also moving back into oil. Money managers' net positioning on Brent, the difference between bets that Brent will rise (longs) and bets that the oil price will fall (shorts), have increased every week in 2019 so far to 266,057 futures and options as of 12 February. There are almost six times as many long contracts as there are shorts, the most the market has been bullish since last October.

This current situation is in marked contrast to the situation in the second half of 2018, when oil supplies were rising at least twice as fast as oil demand, leading to a build-up of global oil stocks. Amid relentless US shale gains, oil producers had ramped up output to compensate for Venezuelan and Iranian supply losses, only to be caught off guard when the Trump administration, fearful of higher oil prices ahead of the US mid-terms, extended sanctions waivers to Iran's major crude importers, thereby mitigating the more severe Iranian supply losses that many had been anticipating. Trump's tough anti-Iran rhetoric had led most to expect a very strict application of sanctions.

OPEC+ compliance off to a slow start

Total OPEC+ production in January came in at 44.75 mb/d, implying that the group had achieved only 66 percent of its target of reducing production by 1.2 mb/d over the first half of 2019. However, this masks considerable overachievement so early into the agreement period on the part of large oil producers such as OPEC Saudi Arabia (130 percent) and Kuwait (117 percent) and non-OPEC Kazakhstan (135 percent) and Mexico (132 percent). Russia (18 percent) and Iraq (-11 percent) stand out among the major producers as having made the least progress, with the latter actually increasing output to above its October baseline reference level.

Nevertheless, there is every reason to believe that, like the 2016 Vienna agreement, the current OPEC+ deal will achieve its objective in the next few months. Saudi Arabia, in particular, appears determined to restore prices to what it probably views as the most appropriate equilibrium range in the age of US shale, around $65-75/bbl. This level is closer to the kingdom's fiscal breakeven oil price level and not too high to crimp oil demand. Saudi's Al-Falih indicated that the country is prepared to go above and beyond the level which is mandated by the OPEC+ production cut and reduce output further from January's 10.2 mb/d to 9.8 mb/d by March, more than 500 kb/d below its target quota. Moreover, conscious of the outsized influence that US data has on oil market perceptions, the kingdom began reeling in exports of its crude to the US market, where every barrel that isn't refined only adds to the country's closely-watched crude stock levels. The question is will that be enough to bring the market to balance and reverse global crude stock builds amid burgeoning US shale production?

Continued US and non-OPEC supply gains in 2019

US crude production is projected to rise in 2019 by up to 1.5 mb/d to 12.4 mb/d, having posted an incredible increase of 1.6 mb/d (19 percent y/y) in 2018 to reach 10.9 mb/d, according to the US Energy Information Administration (EIA).

Growth of 1.5 mb/d in US crude output in 2019 would, therefore, alone outpace the 1.2 mb/d of cuts that OPEC+ is orchestrating. And while the IEA is not so aggressive in its estimate of US crude production growth in 2019, it places non-OPEC supply growth at around 1.3 mb/d in 2019-still higher than the OPEC+ cuts. In light of this, the IEA has revised down the 'call on OPEC', the volume of OPEC crude needed to meet demand, to 30.65 mb/d in 2019. Assuming OPEC achieves 100 percent compliance by the end of 1Q19 and maintains that level through to the end of 2019, we estimate that output from the producers' group will be around 100 kb/d higher than the 'call' at 30.75 mb/d. Importantly, this assumes no further declines in Venezuelan and Iranian production, which is highly unlikely in our view given the structural declines and US sanctions in the former and the high probability that US sanctions waivers will not be extended for the latter. Crude stock increases could therefore be limited to an average of 0.1 mb/d in 2019.

This scenario also does not take into consideration further cuts by Saudi Arabia, which, as mentioned above, seem likely, and makes no distinction between demand for heavy and light crudes this year. Heavy crude premiums on the rise amid supply outages.

With refineries largely geared to maximize petroleum products processed from heavier, sour crudes of the varieties supplied by OPEC and not the light sweet grades supplied from US shale, the issue of the type of crude available on oil markets has come to the fore. Amid cutbacks in OPEC supplies, sanctioned Venezuelan and Iranian crudes and outages in Canada, the supply of heavy sour crude has been dramatically reduced. Pressure on heavy crude prices has been upward, as can be seen in the narrowing spread between Brent (light, sweet) and Dubai and Kuwait Export crude (KEC), which are both heavier and sourer. Over the last several months, these grades have traded at a premium over Brent.

Tighter market on the cards

Current market dynamics imply that once excess supplies from 2H18 are worked off, global supply and demand could balance by mid-2019. The balance of oil price risks, we believe, are to the upside, at least over the first half of the year. Of course, any number of variables could come into play or recede from view that could push prices downwards. Global demand growth could underwhelm, for example, stoked perhaps by weaker-than-expected emerging market economic growth and continuing irresolution to the US-China tariff dispute. US and non-OPEC supply could also surge by more than expected, while OPEC+ could fail to achieve its production cut target, with Russia perhaps cooling on the deal. And then the US could extend Iran sanctions waivers for another six months. Markets should prepare for a bumpy ride in any case

NBK ECONOMIC REPORT