Crude price plunge triggers OPEC+ policy change

KUWAIT: November's fall in oil prices and the just-announced production cuts by OPEC (see below) will impact the growth outlook for the Kuwait economy. The oil sector accounts for around half of GDP in real terms and about 90 percent of government revenues, so recent developments - not yet captured in the forecasts presented in this document - will have a considerable impact on the outlook for both growth and the public finances next year. Meanwhile news on the non-oil economy over the past month was mixed, with real estate sales recovering to solid levels in October but consumer spending weak in November, likely affected by severe weather conditions.

Having declined 7 percent in October, the price of Kuwait Export Crude (KEC) plunged by a still-larger 22 percent in November to end the month at $58/bbl. The fall - triggered by fears of an emerging oil glut due to a combination of higher than expected Iranian output thanks to sanctions waivers for key customers, rising US shale output, and concerns about a global economic downturn hitting oil demand - provoked a change in policy by the OPEC+ group which agreed in early-December to cut output by 1.2 million b/d for six months starting from January 2019. The decision provided some near-term support for oil prices, with the international benchmark Brent jumping 5 percent after the deal was announced before subsequently falling back on concerns that the cuts may still not be enough to prevent oversupply in the global oil market next year.

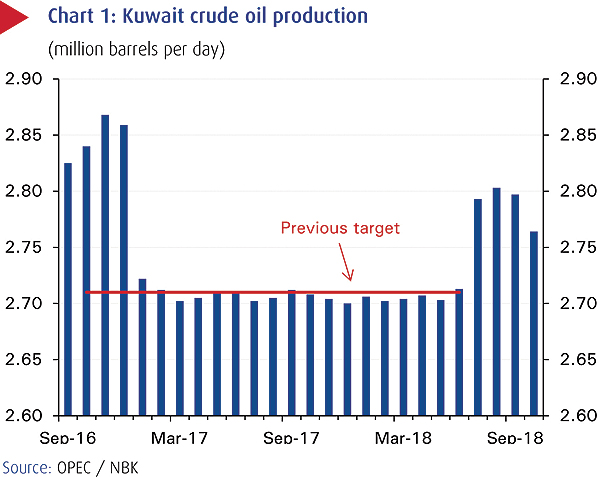

OPEC data show that Kuwait's crude oil output fell back in October to 2.76 million b/d, its second consecutive monthly fall and despite the easing of earlier OPEC production restrictions in the summer that it had been assumed would see production move higher. Although country quotas have not been assigned, OPEC's latest move to trim production could see production move lower still from October levels - which represents the base month from which the latest cuts are applied. These developments came out just before sending this report to publication and therefore we have not yet formally changed our forecasts. But it seems plausible that output could be trimmed back over coming months to the 2.7 million b/d attained before the summer. This would lower our GDP growth forecast for 2019 considerably from its current 4 percent, which was predicated on a rebound in oil output next year.

Real estate sales gain

October data showed relatively solid real estate sales, at KD 285 million, up 31 percent y/y and 42 percent m/m, and representing the second consecutive monthly rise in sales since the slump observed in August. This is well above the monthly average for 2017 (KD 181 million), and slightly above the average for 2018 (KD 265mn). Higher sales were driven by a rise in transactions in the residential sector, but more notably a strong rise in commercial sector activity. Meanwhile, investment sales declined moderately (-9 percent) from the previous month, but still remain relatively solid at just under KD 100 million. The drop in investment sales was despite transactions rising by 39 percent m/m, while the average transaction size for investment properties declined by 34 percent m/m. The latter could be due to either a drop in prices or more likely a change in the type of apartment being traded - i.e. average building size/quality.

Provisional data for the public finances show that the government recorded a fiscal surplus of KD3.1 billion in the first seven months of FY2018/19 (April to October, and before transfers to the Reserve Fund for Future Generations), a sharp turnaround from the KD1.5 billion deficit recorded for the same period a year earlier. Two main factors account for the improvement. First, oil revenues - which typically account for 90-95 percent of all budget receipts - surged 51 percent y/y due to a similar-sized rise in oil prices, while non-oil revenues fell slightly. Second, government spending saw a surprising fall of 9 percent y/y, despite the 8 percent full-year rise factored in to the official budget. Within the overall total, both current (-8 percent) and capital (-13 percent) spending recorded declines.

Although we do not dismiss the weak spending figures entirely, we suspect that the scale of the decline reflects reporting issues and that the underlying spending picture is stronger. The large recorded drop in wages and salaries - the biggest component of the budget and normally paid on time - is particularly unusual.

Without this drop, overall spending would have risen 4 percent y/y. If we are correct and spending at the end of the year is back on track, the budget outcome will turn out to be less buoyant than the latest figures imply - especially once the fall in oil prices since October is factored in. Our current forecast projects a small deficit of around KD 0.4 billion, or 1 percent of GDP, for the year as a whole. But the deficit is likely to be revised higher this year and next once the above factors are taken into account.

Consumer spending dips

Consumer spending contracted by 0.9 percent y/y in November, the first decline in 17-months, following a small pick-up in October. NBK consumer spending index

Source: NBK

The slowdown stemmed from declines across the board, with growth in the consumption of durables (mainly autos) and non-durables contracting, and spending on services easing over the month. The weaker spending figures were almost certainly affected by the restrictions to moving around and emergency public holidays in November triggered by severe weather conditions.

Inflation drops again

Consumer price inflation fell again in October, hitting a near-15-year low of 0.2 percent y/y from 0.3 percent in September. Inflation in most sub-segments of the index was flat-to-falling, with the largest downward contribution coming from the 'miscellaneous' category, where inflation fell to 0.7 percent from 1.7 percent in September. Reflecting this, one measure of 'core' inflation - which excludes food and housing costs - fell to just 1.3 percent; this is just half the rate seen as recently as April. Food inflation also edged down to 0.3 percent, though deflation in housing services (mostly rents) eased slightly to -1.4 percent. These figures highlight the continued broad-based absence of significant price pressures throughout the economy, reflecting a combination of only moderate economic growth, the strength of the dinar against many trade partners' currencies keeping import costs down, and weakness in the housing market which is pressuring rents.

Credit growth edged higher to 2.1 percent in September from 1.7 percent in August, as seasonal factors that weighed on the previous month's performance faded. The uptick was supported by faster lending to both businesses (2.0 percent) and households (6.3 percent) and the usual end-of-quarter jump in lending for the purchase of securities. The non-classified sectors and real estate were the sectors that experienced the most increases, while lending to the trade sector fell for a second consecutive month. Meanwhile, private deposits increased by a strong KD455 million, driven by gains in KD sight deposits and FC deposits. This helped push growth in the M2 money supply measure to 4.8 percent y/y, up from 4.4 percent in August.

The Boursa Kuwait All Share index logged its first increase in four months in November, up 1.3 percent m/m, buoyed by strong activity in its premier market (1.6 percent) which accounted for more than two-third of the month's average daily traded value (KD 11 million/day). The segment is benefitting from Boursa's inclusion into FTSE's Emerging Market index, which will see 11 out of the 17 premier listed companies fully join the index late in December. Sector-wise, the increase was led by telecoms, real estate, consumer services, and financial services. Overall, the improving dynamics helped grow the market capitalization by KD 475 million to KD 29.2 billion.

As the market prepares for the second tranche of the FTSE inclusion in December, another $500 million in foreign inflows are expected. So far, the market has seen $473 million in net foreign and GCC inflows, making up 23 percent of total traded activity during the month, up from 18 percent the previous month.

NBK ECONOMIC REPORT