NBK Capital to issue World Energy Outlook 2019

KUWAIT: International oil prices held stable from beginning January to beginning February 2019, affected by concerns regarding a slowing global economy, reports the NBK Capital World Energy Outlook 2019. Doubts regarding the ongoing US-China trade dispute, in addition to the possible return of Libyan supplies to world markets are also impacting price.

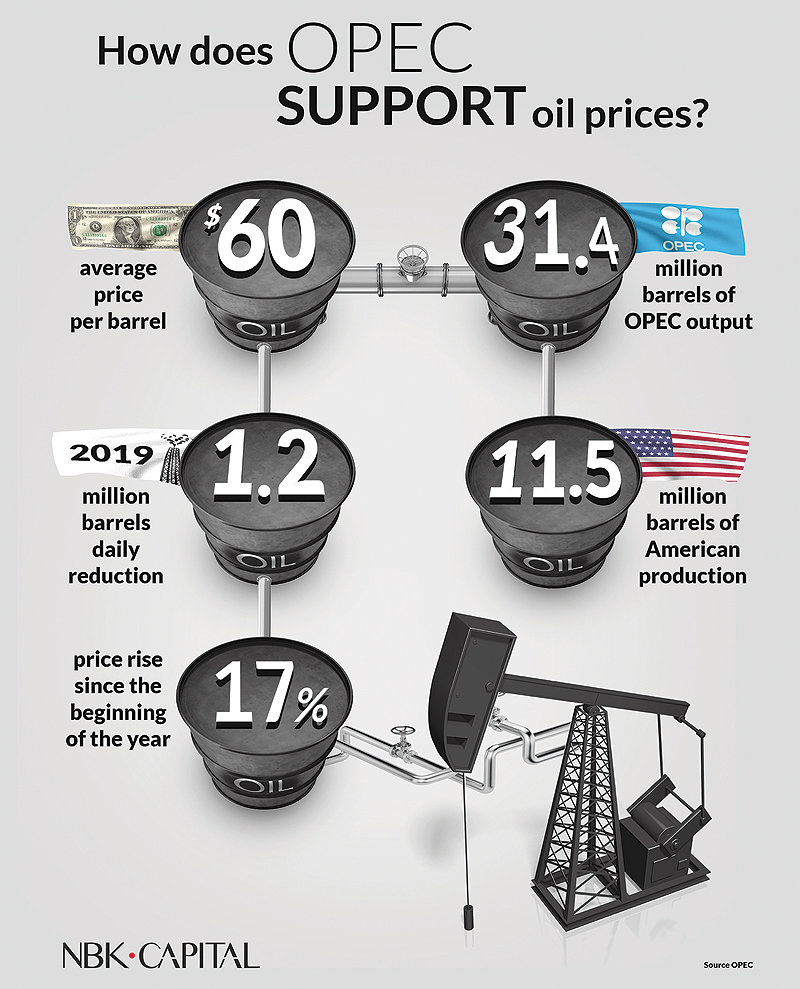

Oil prices were buoyed by news that OPEC and its allies have achieved significant progress in reducing production by 1.2 million barrels per day, reducing global oversupply. Saudi Arabia has cut production by 350,000 bpd to 10.213 million barrels; Kuwait and the UAE have also significantly reduced production.

The oil market is heading towards a rapid depletion of abundant supply due to several factors including: sanctions on Iran and Venezuela and disruption of production and force majeure in Libya's spark field. At the same time, OPEC+ producers continue efforts to control supplies by reducing production. These cuts by member states exceed pre-commitments due to additional voluntary Saudi-led reductions and other involuntary reductions as a result of geopolitical factors including sanctions on producers Iran and Venezuela.

Venezuela sanctions

US sanctions against Venezuela are the biggest challenge facing the oil market now, especially in light of the International Energy Agency's warnings of a problem with the quality of crude, where there is an abundance of US light oil supplies but a scarcity of heavy crude. Venezuela's sanctions will not only affect US refineries in the US Gulf coast but will also spill over into European markets, which depend on imports of heavy Venezuelan crude.

China-US trade war

The 90-day truce in the China-US trade war agreed last December, which ends on March 1, has paved the way for boosting world oil prices to levels that are acceptable so far. The current improvement in China's trade data is one of the key indicators supporting global oil demand. This could help push prices further towards recovery, although this depends entirely on the success of China-US trade talks, which in the end is in the interest of supporting economic growth. Although US crude oil production has risen to 11.9 million barrels per day, cutting OPEC output as demand grows will push the oil market back to balance by mid-year.

The market is looking forward to the return of US energy officials to China for the last round of trade talks, which include prospects for trade in crude oil and LNG between the two countries this year, and the possibility of normalization of relations.

The NBK Capital World Energy Outlook 2019 also noted that US oil exports to China fell in August and grew in November. According to the latest data from the US Energy Information Administration, oil trade between the two countries was a victim of the trade war, although China has not imposed a new tariff on crude.

US production

US Energy Information Administration data showed US crude inventories rose 1.3 million barrels in the week ending Feb. 1 to 447.21 million barrels. In the meantime, the average weekly production of US crude hit a record level of 11.9 million barrels per day, reached in late 2018.

In the United States, the number of rigs looking for new oil production, dropped from a peak of 888 in 2018 to 873 earlier this year, bringing US crude production to a record low of 11.7 million barrels per day. At the latest OPEC meeting in Vienna, OPEC and its Russian-led allies said they would meet again in April, without giving a specific date, to decide on extending the oil production reduction agreement, which came into force on Jan. 1. The recovery in oil prices this year would boost hopes among producers that the supply cut agreement is bearing fruit.

Oil prices in January rose 15 percent on a monthly basis, and Brent crude rose 22.6 percent to $61.9 per barrel after reaching a bottom on December 24 until the end of January, and WTI increased by 26.47 percent to $53.8 per barrel during the same period. Oil markets have been boosted by Saudi Arabia's announcement that it expects to cut its oil production in February to levels far below the levels set by the OPEC + agreement.