KUWAIT: The performance of the GCC markets was largely negative in October in a continuation of a general weakness which has been prevailing since the end of April. The S&P GCC Index declined by 2.67% during the month almost exhausting all of the positive year-to-date performance that was accumulated during the first few months of the year.

The Index' performance since the beginning of the year now stands at 0.49%. Leading the decline was the Saudi Tadawul All Share Index which lost 4.30% in October turning negative for the year at -1.06%. It was followed by Qatar Exchange Index and Dubai DFM General Index with declines of -1.72% and -1.23% respectively.

On the positive side, Abu Dhabi's ADX General Index was the best performer with a gain of 1.0%, followed by Kuwait All Share Index which added 0.68% and Bahrain Bourse All Share Index with a marginal gain of 0.44%. The wider S&P Pan Arab index slightly outperformed its GCC counterpart with a loss of 2.30% supported by a positive performance in Egypt as the EGX 30 added 2.11%. Emerging markets strongly outperformed in October led by the performance of Asian markets.

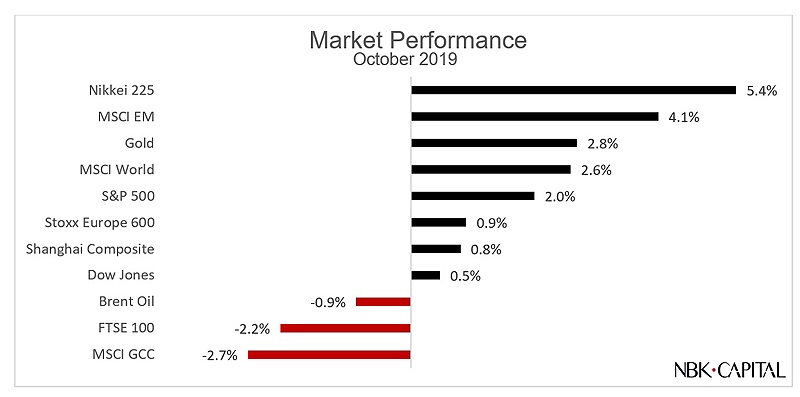

The MSCI EM Index advanced by 4.09%, while the MSCI Asia ex-Japan Index added 4.49%. The two indices are up by 7.89% and 8.20% for the year respectively. The Russian Stock Exchange recovered strongly with an advance of 5.34% during the month while the Taiwan Stock Exchange Index added 4.89%. other notable movers include the India's Nifty 50 which advanced by 3.51% and Turkey's Boursa Istanbul 100 Index which declined by -6.25% slashing its year-to-date return by half from 15.1% last month to 7.9% in October.

Global financial markets found support during October in easing trade tensions between the US and China, a diminishing risk of no-deal Brexit, and expectations of a Fed rate cut which was realized at the end of the month. The MSCI AC World Index added 2.64% during October, bringing its year to date performance to 17.28%. Emerging markets also rallied and the MSCI Emerging Markets Index advanced by 4.09% after having declined by 5.11% during the third quarter.

In the US, preliminary third quarter GDP estimates show an advance of 1.9% on an annualized basis compared to a consensus estimate of 1.6% and a second quarter advance of 2.0%. Inflation showed an uptick as core PCE for the third quarter came in at a preliminary 2.2% up from 1.9% for the second quarter. The ISM manufacturing PMI, on the hand, bounced back slightly from 47.8 recorded in September to 48.3 in October but was still below expectations of 48.9.

Employment figures also showed signs of stabilization in the US economy which added 128,000 jobs during October against expectations of 89,000, while average hourly earnings continued to recover recording a 3.0% increase year-on-year. The unemployment rate ticked marginally higher to 3.6% from 3.5% during the previous month. The US Federal Reserve cut interest rates for the third time this year by a quarter of a percentage point to a range of 1.50% to 1.75%.

The Fed Chair indicated that the rate cut was done to help sustain US growth but clearly signaled that there would be no further cuts "as long as incoming information about the economy remains broadly consistent with our outlook". US Indices advanced steadily during October and reached new all-time highs shortly after the close of the month boosted by strong US economic data. The S&P 500 added 2.04% while the Down Jones Industrial Average underperformed with an advance of 0.48%. The two indices are now up 21.2% and 15.9% since the beginning of the year.

The Nasdaq strongly outperformed advancing by 3.7% during October and 25.0% for the year. In the treasury market, the 10-year yield closed the month virtually unchanged at 1.69% compared to 1.67% at the end of September after declining from a month high of 1.85% after the Fed decision to cut rates. On the shorter end of the curve, the two-year rate initially declined to a low of 1.42% during the first week of October before recovering steadily and closing the month at 1.52%.

In Europe, the ECB left rates unchanged during its October meeting but gave a very negative assessment of the outlook of the European economy. During his last ECB policy meeting before stepping down, president Mario Draghi warned that slowing global growth and uncertainty over Brexit are threatening the euro-zone economic growth, especially with a weak German economy, saying that the risks are "all to the downside".

Preliminary European GDP figures for the third quarter showed a year-on-year growth rate of 1.1% down from 1.2% for the second quarter. Inflation ticked slightly upwards as preliminary figures showed the Consumer Price Index increasing by 1.1% in October from 1.0% in September. Manufacturing activity remains weak with the Markit Manufacturing PMI unchanged from the previous month at 45.7.

The German economy is still weighing down significantly. Germany's Markit Manufacturing PMI increased marginally to 41.9 in October up from 41.7 while the unemployment rate stabilized at 5.0%. Despite this generally negative picture, European markets managed to record a good performance during the month. The Stoxx Europe 600 advanced by 0.92% bringing its year-to-date performance to 17.5%. The German DAX and French CAC 40 added 3.53% and 0.92% respectively.

Markets in the UK bucked the global trend as the FTSE 100 saw a -2.16% decline during October. The Gfk Consumer Confidence Index declined to -14 against expectations of -13 and a September level of -12. Inflation numbers for September came in unchanged at 1.70%, while the Markit Manufacturing PMI continued its improvement and climbed to 49.6 in October against consensus estimates of it dropping back to 48.1 from 48.3 in September.