LONDON: Europe's stock markets dipped yesterday, mirroring Asia on growing fears over an end to central bank largesse. "Tepid ... trading has seen investors choosing to react to further weakness in Asian markets, as opposed to the further strength of Wall Street," noted Interactive Investor analyst Richard Hunter. London stocks shed 0.4 percent just after midday, while Frankfurt fell 0.6 percent and Paris dropped 0.4 percent in early afternoon eurozone deals. Asian markets fell after South Korea became one of the first major economies to start lifting interest rates since they were cut to record lows last year to battle the coronavirus impact.

Sentiment also remains blighted by the prospect of an end to Federal Reserve's emergency financial support. "South Korea are leading the way when it comes to removing emergency stimulus measures and tightening policy," said OANDA analyst Craig Erlam. "Others have considered similar moves and will likely follow in the coming months," he added.

Erlam said many central bankers now are concerned about their economy overheating, and are pointing to higher inflation or financial stability risks as reasons to tighten monetary policy. Equities and oil have by and large enjoyed a positive week, helped by full US approval of Pfizer-BioNTech's vaccine and speculation the Fed will take its time in removing its ultra-loose monetary policy whenever it begins to do so.

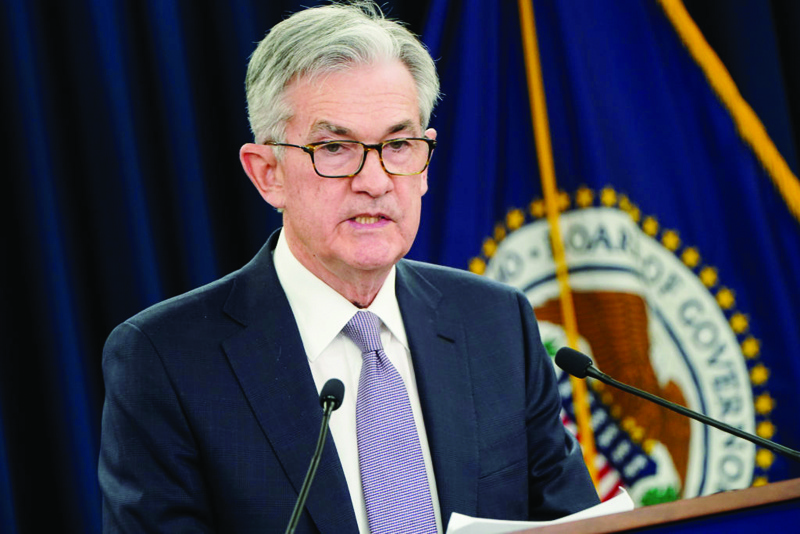

However, while Wall Street continued to chalk up new records, Asian and European investors shifted a little more cautiously as they assessed the outlook. Top of the agenda this week is Fed boss Jerome Powell's speech today to the Jackson Hole symposium of economists, which will be closely followed for any indication about its policy plans in light of rising inflation and the economic rebound.

The bank is widely expected to begin easing back on its vast bond-buying programme by the end of the year, though the spread of the Delta variant and its impact on growth has some observers and even hawkish Fed members rethinking the wisdom of doing so. Analysts said the speed and timing of a pullback could be crucial. However, some warn that starting to taper too late could cause problems. Back in Asia, Hong Kong and Shanghai each fell more than one percent as tech firms were dragged down by weak earnings results that came as China embarked on its crackdown on the industry. - AFP

.jpg)