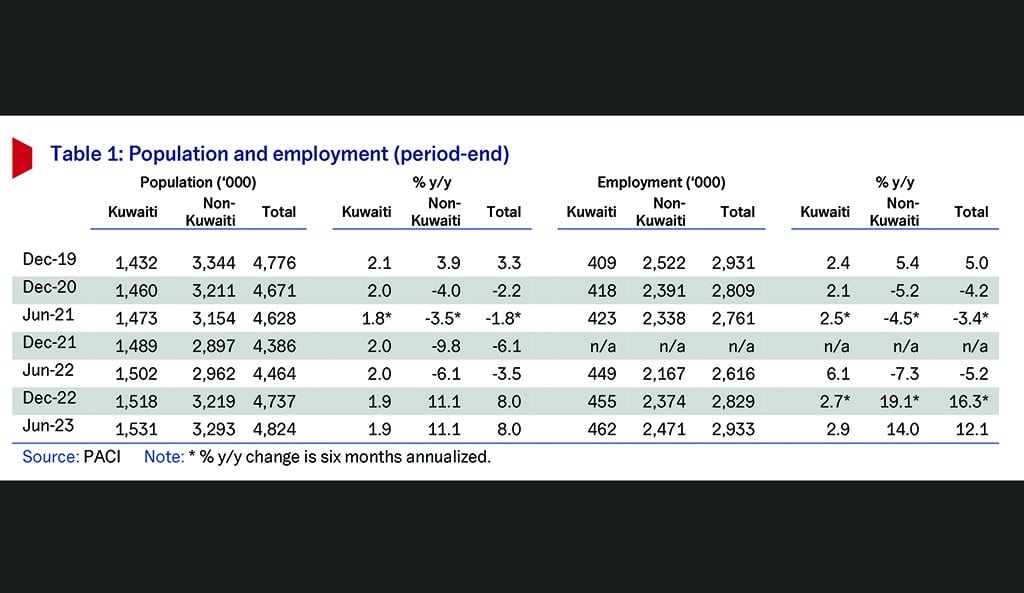

KUWAIT: Kuwait’s population increased by 8 percent y/y in H1 2023 to 4.82 million, surpassing its pre-pandemic peak for the first time, helped by steady growth in the Kuwaiti population and a further recovery in the non-Kuwaiti demographic in line with the post-pandemic improvement in the economy. Employment saw a similarly large rise, with non-Kuwaiti job gains concentrated in the lower-end category, and helping to resolve some of the labor shortages witnessed during 2021-22.

However, expatriate employment (excluding domestic staff) is still 6.6 percent below its peak in 2019. Meanwhile, Kuwaiti job seekers continue to overwhelmingly favor public sector jobs, leading to further falls in private sector employment. Overall population growth in the year to June 2023, according to data from the Public Authority for Civil Information (PACI), was the highest since 2005 and a similar rate to that recorded in 2022. The Kuwaiti population rose by 1.9 percent to 1.53 million, a steady though slowing rate of growth from the 2.5 percent annual average rises witnessed during the 2010s.

The working-age population continues to rise (now 62.7 percent of the total population), given a large cohort of people below 15 years (32.3 percent) that would gradually enter the workforce over the coming years. In addition, the proportion of elderly citizens has also steadily grown (4.9 percent currently), in line with the trend seen in many emerging and developed markets.

Meanwhile, the non-Kuwaiti population recorded another sharp rise of 11 percent to 3.29 million, almost bridging the gap with its pre-pandemic peak (-1.5 percent versus the 2019 level).Foreigners now form 68.3 percent of the total population compared to a low of 66.1 percent at the end of 2021 – but lower than the pre-pandemic 70.0 percent.

Moreover, a large part of the rise in non-Kuwaitis came from domestic workers, which jumped 16 percent y/y to 811K, constituting some 25 percent of the total expat population from 22 percent at the end of 2019. Despite the substantial growth over the last 18 months, the overall population remains some 9 percent below where it would have been (5.3 million persons), had the pre-pandemic population growth trend been sustained.

Public sector jobs

The number of employed Kuwaiti citizens increased by 2.9 percent y/y to 462K by the end of H1. In the first six months of 2023, the public sector gained 8.2K jobs, while the private sector shed 1.3K positions, taking the employment level in the above sectors to 389K and 73K, respectively. The number of unemployed citizens inched up to 28K from 26K at the end of 2022, with an implied unemployment rate of 5.8 percent.

In its recently approved budget (FY2023/24), the government announced its plan to hire around 20K Kuwaitis this year, which will add further momentum to the trend of increasing public sector employment. Meanwhile, the female share of Kuwaiti employment rose further to 51.7 percent in H1 2023from its low of48.1 percent in 2017, with the female labor force participation rate improving to 50.9 percent from 50.2 percent at the end of 2022.

In contrast, the male labor force participation rate has stayed near its historic low of 50.6 percent. There are more male students as a percentage of the working-age population (15-64) than female students in their respective gender brackets (31 percent versus 29.6 percent), contributing to the contrasting trends in the labor participation rate.

Low-end employment

As economic activities continue to normalize and momentum in the projects market picks up, the number of foreign workers (excluding household domestic workers) witnessed a strong 13 percent y/y increase in H1. However, the addition of 58K new workers during the first six months of 2023 is a material slowdown from the 134K added in H2 2022. The number of domestic workers rose an even faster 16 percent y/y. The influx of workers has eased the labor shortages cited by employers in the aftermath of the COVID pandemic in 2020, when many laborers left the country.

The proportion of less qualified workers (educational qualification at secondary level and below, including those with no stated qualifications) has now increased to around 92 percent from 90 percent as of June 2022, underpinning the revival of lower-end jobs, including domestic staff. While lower-skilled laborers are essential for projects, construction, and longer-term economic development, their impact in terms of consumption is probably softer, given their low incomes. Meanwhile, a stricter local visa regime, moderate economic growth, and strong competition for attracting high-skilled expat talent from other GCC countries may have dampened hiring of skilled workers.

Population growth to slow

Going forward, we see population growth slowing from recent rapid rates, as the post-pandemic readjustment fades. In the decade to 2019, population growth averaged around 3 percent per year. This included annual growth of 2.5 percent among Kuwaiti nationals, which has since decelerated to just under 2 percent as mentioned above due to a steadily falling birth rate, possibly explained by delayed marriages and rising career aspirations among young Kuwaitis.

Meanwhile, growth in the expat population is likely to slow from its previous 3.5 percent per year average given government ambitions to rebalance the population structure over time. On the employment front, a continued decline in private-sector Kuwaiti jobs runs counter to the authorities’ Vision 2035 goal to Kuwaitize the private sector and ease the burden on the public finances, as well as to reinvigorate the business community more broadly.

Targeted measures such as enhanced incentives for private sector jobs, disincentives to work in the government sector such as aligning work practices and timings with the private sector, and more general initiatives to expand job opportunities in the private sector will warrant serious deliberation.