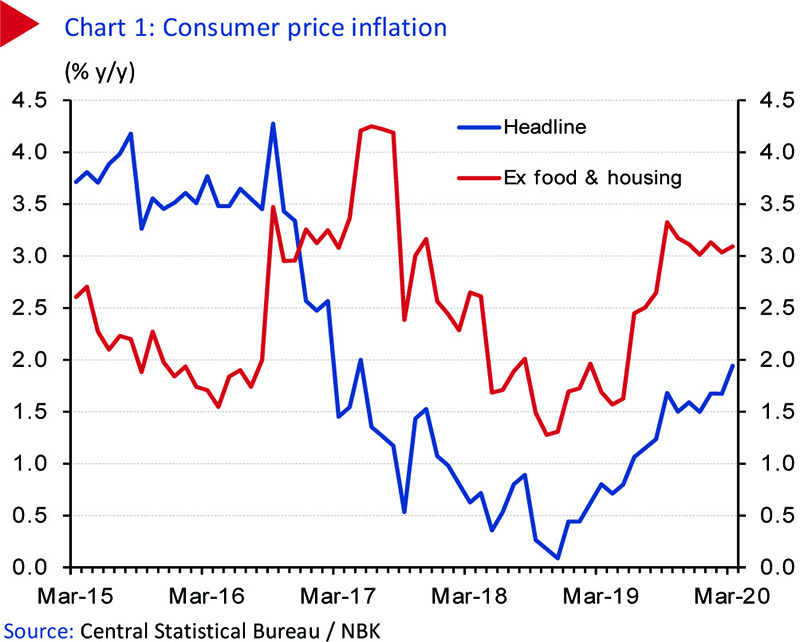

KUWAIT: Consumer price inflation rose to 1.9 percent y/y in March from 1.7 percent in February and 1.5 percent at the end of 4Q19. The pick-up in inflation appears to have been driven by a combination of rising prices in the food and furnishing & household maintenance categories as well as by a lessening of deflation in housing rents.

‘Core’ inflation, which excludes both food and housing, was quite strong at 3.1 percent. It is worth noting, however, that given the COVID-19 pandemic-induced lockdown and business closures in place since mid-March, it is likely that statistical sampling was difficult, affecting the quality of the data.

Food inflation

Food price inflation jumped from 1.8 percent y/y in December 2019 to an almost four-year high of 2.8 percent in March 2020, in part reflecting a low base and as inflation in the volatile fish and seafood category remained in double digits (11.2 percent). International food prices, by comparison, remained in decline, and are likely to keep local food prices in check, which are also subject to subsidies and price controls. Indeed, local authorities ramped up efforts to prevent price gouging, especially during the height of the pandemic, when travel restrictions and fear of food shortages led to sharp rises in front-loaded purchases of consumer staples.

Meanwhile, housing costs declined by 0.2 percent y/y in March, decelerating at the slowest pace in almost three years and versus -0.9 percent in December. While the rate of decline in housing rents appears to have bottomed out after seeing years of weakness due to oversupply in the apartment market, the segment is likely to face a fresh wave of declines in the months ahead on the back of weaker growth and a fall in housing demand as the number of expats potentially drop.

Core inflation

Core inflation held firm at 3.1 percent y/y in March, up slightly from 3.0 percent in December, as higher inflation in the ‘services and miscellaneous goods’ (up 1.5 percent q/q to 4.0 percent y/y) and clothing (up 0.4 percent q/q to 2.8 percent y/y) categories more than offset lower inflation rates in other core components such as transportation (down 0.2 percent q/q to 3.6 percent y/y) and household goods.

Inflation in the miscellaneous segment was mainly driven by a rise in jewelry prices, which were mostly likely driven by higher gold prices, not least because of increased economic uncertainty in the three months to March. Meanwhile, the pick-up in inflation in the clothing segment was in part due to a low base.

That said, with consumer spending taking a major hit in 2Q20 from strict virus-containment measures in place since mid-March (including a full 24-hour lockdown through most of May), a slowdown or drop in spending on these items as well as other discretionary items may weigh on prices in the months to come.

Wholesale price inflation

Wholesale price inflation, which measures prices charged between some businesses rather than to consumers, stood at a subdued 0.7 percent in March, unchanged from December. Although not a complete measure of businesses’ costs, subdued wholesale price inflation should limit the pressure on retailers to increase prices.

While inflation in the price of imported goods was relatively constant during the same period, inflation in the price of locally produced goods eased from 0.8 percent to a mere 0.4 percent, pointing to limited upward inflationary pressures from domestic wholesale prices.

Inflation to ease in 2020

Given the economic fallout from the pandemic in relation to consumer demand, we now expect inflation to ease from an annual average of 1.1 percent in 2019 to likely 1.0 percent or lower in 2020. Downside risks predominate, with weaker housing demand on the back of a possible drop in expat numbers likely to usher in a fresh wave of declines in rents and thus weigh on headline inflation. Additionally, food price inflation will likely be kept in check by government initiatives to prevent price gouging during the pandemic.

Meanwhile, core components, especially discretionary consumer items such as clothing and household goods are also likely to face downward pressures. While we may see continued strength in the miscellaneous segment and a pick-up in transport costs, led by potential hikes in airfares due to limited travel capacities, and communication costs, not least because of pent up demand for video-conferencing services, these are likely to be offset by lower inflation rates in the other core components.