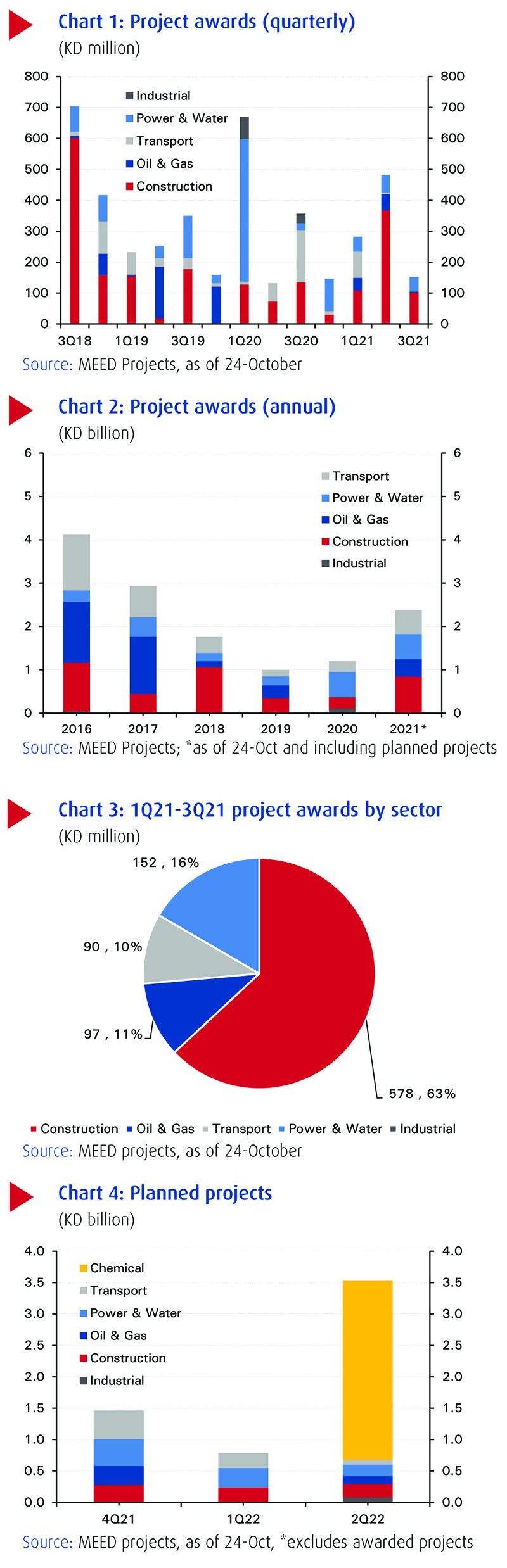

Total value of projects awarded in 2021 reaches KD 916 million

KUWAIT: The total value of awarded projects in Kuwait fell to KD 152 million (-68 percent q/q; -57 percent y/y), according to MEED projects. This brings the total value of projects awarded in 2021 to a cumulative KD 916 million so far. With the fourth quarter underway already, the full-year figure is likely to fall a long way short of the KD 2.4 billion earlier projected by MEED. The decline is due to delays in government tendering and approvals amid cutbacks in capital spending as well as pandemic-linked supply chain constraints that have led to increases in the cost of materials and labor.

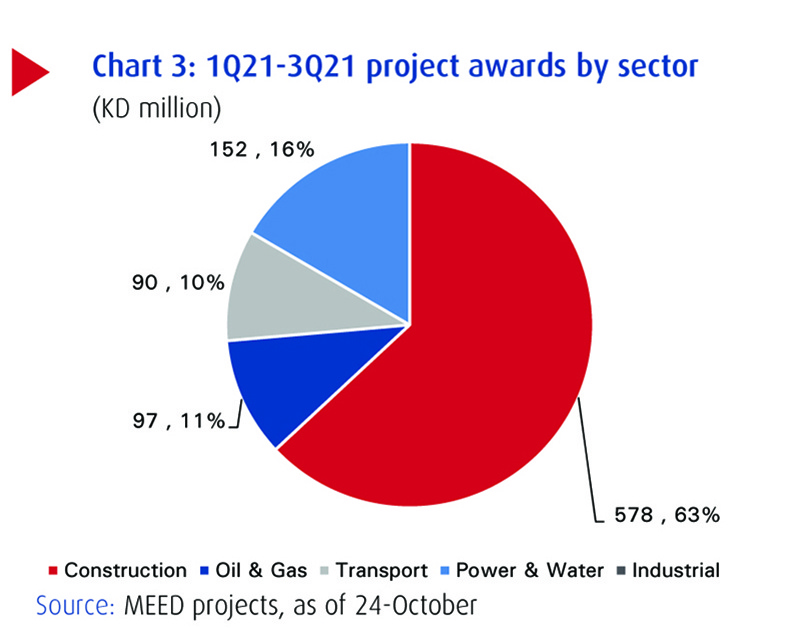

Construction sector awards came in considerably weaker than in the previous quarter (-72 percent q/q). It was, though, the strongest performing sector, both in 3Q21 with KD 102 million worth of projects awarded and in the year so far with 63 percent of all projects falling in this sector. KOC and KERP’s Excavation Transportation & Remediation Project: Zone-3, worth KD 75 million, was the largest project awarded during the quarter, followed by PAHW’s Al-Mutlaa City: Soil Works contract, worth KD 26 million. Several project awards are expected in 4Q21, including the PAHW’s Public Buildings at South Abdullah Al-Mubarak: Blocks 1-6 (KD 96 million) and a portion of the Sabah Al-Ahmed Township project (KD 75 million).

The power and water sectors also witnessed a slowdown in project activity in 3Q21, with awards falling 17 percent q/q to KD 47 million. Two contracts under the PAHW’s Extension & Maintenance of Medium & Low Tension Cable Networks project were awarded. The fourth quarter of the year should see KD 431 million worth of projects awarded, including several contracts related to the MEW’s Fresh Water Pipeline project (KD 105 million) and smaller scale projects in the power sector worth around KD 258 million.

No projects were awarded in the transport sector in 3Q21. This is the second consecutive quarter of minimal activity, following 2Q21’s outturn of KD 5 million. Looking ahead, KD 452 million of transportation awards, including two parts of MPW’s Northern Regional Road (KD 189 million) and the Crossroads for New Passenger Terminal 2 (KD 120 million) are expected by the end of 2021.

Activity in the oil and gas sectors also slowed significantly. Total awards declined by 93 percent q/q to KD 4 million, which was essentially KOC’s Installation of Flow Lines for Producer Wells project. Kuwait’s oil and gas sector has KD 308 million in awards planned for 4Q21, including KOC’s JPF 4 & 5 Production Facilities (KD 294 million) and several smaller scale oil projects. However, given recent trends, we could see this project pushed back into early 2022.

Lastly, Kuwait’s chemical sector, which has been quiet for the past few years, should finally see some movement, with the contracts expected for the Al-Zour Petrochemical Complex (KD 2.85 billion) by Kuwait Integrated Petroleum Industries Company (KIPIC). This is not likely before early 2022, though.

MEED Projects sees KD 1.5 billion worth of projects awards coming through in 4Q21. For 2021 as a whole, however, project activity is likely to be softer than initially expected.