Hike in electricity and water tariffs may nudge prices up

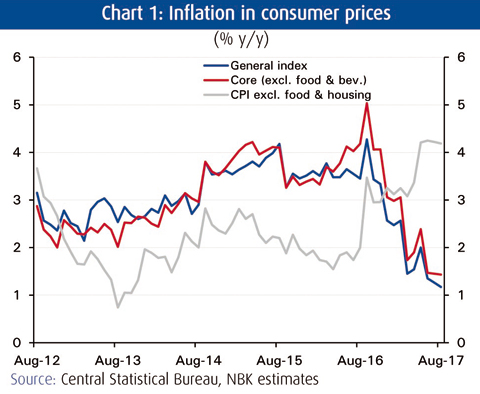

KUWAIT: Kuwait's consumer price inflation eased to a new multi-year low of 1.2 percent in August, mainly on the back of deflationary pressures from the housing component and weak food inflation. Core inflation, which excludes housing rent and food costs, remained more pronounced at 4.2 percent year-on-year (y/y), primarily due to the direct and indirect effects of the fuel price hikes imposed in September 2016. Nonetheless, these effects have largely subsided recently and are slated to witness a downward correction in the near- to medium-term due to base effects. In this setting, the overall inflation rate is expected to face some further downward pressure during the same period. If transportation costs are excluded, inflation held at a healthy 2.3 percent y/y thanks to ongoing inflationary gains in services excluding housing rent.

The country's inflation is now likely to average closer to 1.5 percent in 2017, noticeably lower than the 3.5 percent annual average recorded in 2016. While hikes in electricity and water tariffs on the apartment sector, which took effect in August, are projected to apply upward pressures in the months ahead, these pressures are likely to be partially offset by the deflationary rates in housing rent, soft food inflation and fading price growth in the transportation sector.

Housing rents remained in deflationary territory in August. Inflation in housing services - mostly comprised of housing rents and updated quarterly - slowed sharply from the second half of 2016 onwards, in line with softer activity in the housing market. Rental costs saw their first decline in years during 1Q17. In 2Q17, rents declined by a further -2.3 percent y/y.

Local food price inflation remained stubbornly weak on the back of softer inflation in global food prices. Local food prices declined by a mere -0.2 percent y/y in August as the pace of increase in international prices of commodity foods softened. According to the Commodity Research Bureau, global food price inflation reversed its upward trend in August and fell from an almost three-year high of 4.4 percent y/y in the preceding month, to a mere 0.5 percent y/y. This softness is projected to limit any significant increases in local food costs over the forthcoming months.

Inflation in the retail sector was mixed but still reflected some improvements in consumer demand as well as a weaker dinar. Inflation in clothing & footwear eased in August, but at 1.6 percent y/y it remained near multi-month highs. Inflation in "other goods & services" and furnishings & household maintenance remained relatively solid at 2.1 percent y/y and 3.5 percent y/y, respectively. The relatively more elevated inflation rates across these three major retail segments, mirror the improvements being witnessed in consumer demand and the recent depreciation in the local currency. The weaker dollar continues to weigh on the dinar's trade-weighted index, which is currently down 3.5 percent year-to-date. Since a large proportion of the goods in the retail sector are imported, the weaker currency has propped up costs in the sector. Inflation in services excluding housing has been healthy around 3-4 percent thus far in 2017. Inflation in this component has been supported by double-digit inflationary gains in transportation costs. While it may edge lower in the near term as the impact of last year's fuel price hikes fades, it is still expected to be supported somewhat by ongoing gains in inflation in recreation & culture.

NBK ECONOMIC REPORT

Hong Kong Bannar.jpg)