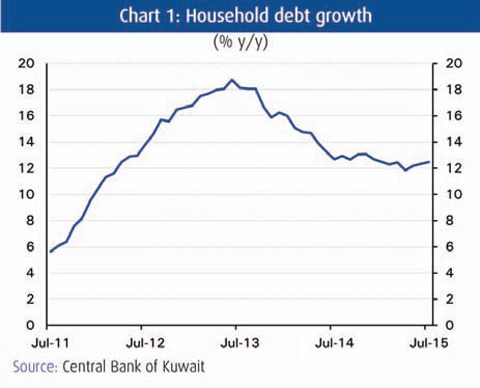

Household's debt growth stood at 12.5 percent year-on-year (y/y) in July, mostly unchanged from the pace a year ago. Personal facilities excluding credit for the purchase of securities rose to KD 10.2 billion. Most of the growth has been in installment loans, which largely finance home acquisition. Installment loans grew by 15 percent y/y in July, with the pace picking up slightly from a year ago. This most likely reflects the role strong demand for housing plays in driving household debt growth.

Consumer spending remained relatively robust, though it has begun to moderate in 2015.While growth in the value of point-of-sale transactions (POS) in 2Q15 stood at a healthy 12 percent y/y, it was still the slowest in over three years. If consumers' ATM cash withdrawals are also included, spending softened to 8 percent. National account data also pointed to some moderation in consumer spending, as nominal private consumption growth eased to 5.9 percent in 2014 (preliminary figures), it slowest pace in four years. In real inflation adjusted terms, growth also slowed.

Employment among Kuwaiti nationals has been picking up slightly over the last 12 months, providing some additional support to the sector. New hires among Kuwaitis over the 12 months ending in June 2015 are estimated at 21,900 compared to 20,100 a year before.Net employment growth has been mostly steady at around 3 percent y/y.

Hiring among skilled expatriates appears to have slowed somewhat over the last 12 months, especially among the more highly skilled. Employed non-Kuwaitis with at least a secondary education rose by 8,600 during the 12 months ending in June 2015, down from 15,000 a year before. The weakness was more notable among those with a university education. By contrast, total expatriate employment in the private sector continued to see strong growth, rising by 7.5 percent y/y, implying robust growth in the unskilled segments.

The consumer sector is expected to maintain healthy growth, supported by robust hiring and healthy consumer sentiment. Employment growth among Kuwaitis, combined with strong housing demand, is likely to continue to drive strong household debt growth. The weaker hiring trend among skilled expats could hurt growth slightly, though the impact is expected to be relatively small.