KUWAI: Gulf Bank K.S.C.P. ("Bank") announced its financial results for the year ending 2018.

Financial summary

Net profit increased from KD 48 million in 2017 to KD 57 million in 2018, an increase of 18 percent. This is the fifth straight year of double-digit growth in net profit for the Bank.

Earnings per share increased to 20 fils per share and the Board of Directors is recommending a cash dividend of 10 fils per share for shareholders' approval at the Annual General Meeting to be held in March 2019. Cash dividends paid have increased from 4 fils per share in 2016 to 7 fils per share in 2017 to 9 fils per share in 2018.

Loans and Advances to customers reached an all-time high of KD 4.2 billion at the end of 2018, an increase of nearly KD 0.5 billion or 13 percent over the last two years. This growth was well balanced as 57 percent came from the Bank's Corporate segment and 43 percent came from the Bank's Consumer segment.

Non-Performing Loans (NPLs) reached an all-time low of 1 percent. This was driven mainly by the settlement of two legacy corporate loans in the second half of 2018, one of which led to a recovery of KD 36.5 million recorded in the fourth quarter of 2018.

The IFRS9 accounting standard on credit facilities was implemented by the Central Bank of Kuwait in 2018 and, as of year-end 2018, the Bank's total credit provisions of KD 312 million were greater than the IFRS9 requirements by KD 112 million.

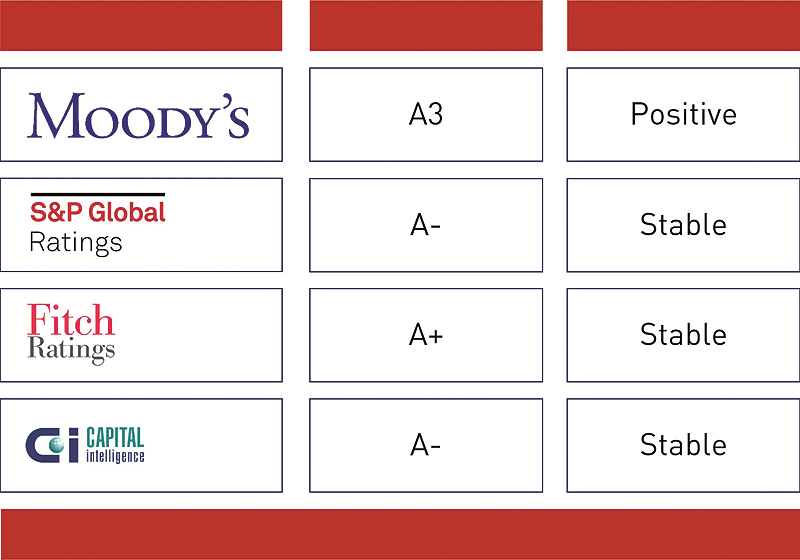

The Bank's regulatory capital ratios remained strong as the Tier 1 ratio of 14.1 percent was 2.1 percent above the regulatory minimum of 12 percent and the Capital Adequacy Ratio (CAR) of 17.5 percent was 3.5 percent above the regulatory minimum of 14 percent. The Bank maintained its 'A' ratings from the four major credit rating agencies. Moody's Investor Service maintained a rating of A3 and upgraded the outlook of the Bank to 'Positive' from 'Stable' while Capital Intelligence upgraded the rating to 'A-' from 'BBB+'. Fitch Ratings have also affirmed their ratings at 'A+' with a 'stable' outlook and S&P Global Ratings affirmed the Bank rating at 'A-', with a 'Stable' outlook as well.

Commenting on the results, Omar Kutayba Alghanim, Gulf Bank's Chairman said: "We are extremely happy with our Bank's performance in 2018. We have delivered strong financial results to our shareholders, and we continue to be relentless in our mission to deliver value, service, and innovation to our customers who live and do business in Kuwait and beyond."

Business Highlights

To serve its retail customers, the Bank now has 58 branches in Kuwait and has plans to open more in 2019 and beyond. In addition, the Bank has leveraged its new credit card system by offering a new line-up of credit cards with benefits tailored to each of its customer segments and a new cashback card to supplement the Bank's popular rewards program. In addition, the Bank signed agreements with several retailers in Kuwait to offer an interest-free program to their customers to drive more sales for them and more customers for the Bank. Gulf Bank also launched the "WISE" investment platform for its wealth and priority customers, and a new state-of-the art website.

To serve its domestic and multinational corporate customers, the bank continues to leverage its product and service capabilities to offer a range of tailor-made financial solutions. The Bank covers all industries with a focus on financing government projects, especially those that are part of the Kuwait National Development Plan 2035.

CSR and Sustainability

Sustainability continues to play an integral role in the Bank's CSR initiatives. Gulf Bank's social responsibility programs support events focusing on youth and education; women empowerment; health and fitness; and Kuwait's heritage. "We see increasing demand from investors, customers, regulators and our own employees around social responsibility and sustainability. We aim to invest in our communities and engage with our partners to promote social and economic development that will ultimately drive sustainable growth in our beloved country, Kuwait." said Mr. Alghanim.

Gulf Bank also continues to sponsor INJAZ-Kuwait as part of its commitment to encourage and develop professional business skills amongst youth. To date, Gulf Bank has participated in four INJAZ Al-Arab programs, 47 INJAZ Kuwait Job Shadow Days, 69 INJAZ Kuwait Innovation Camps, and 120 INJAZ Kuwait Entrepreneurship Master Class workshops.

Appreciation

Alghanim concluded his remarks by stating: "On behalf of the Board of Directors, we express our gratitude and appreciation to the Central Bank of Kuwait and the Capital Markets Authority for their dedicated efforts in supporting and promoting Kuwait's Banking sector. I would like to offer our sincere thanks to our valued customers for their continued trust in Gulf Bank as their loyalty is at the core of our success. Finally, I would like to thank the entire Gulf Bank team for their dedicated service and being part of the Gulf Bank family."