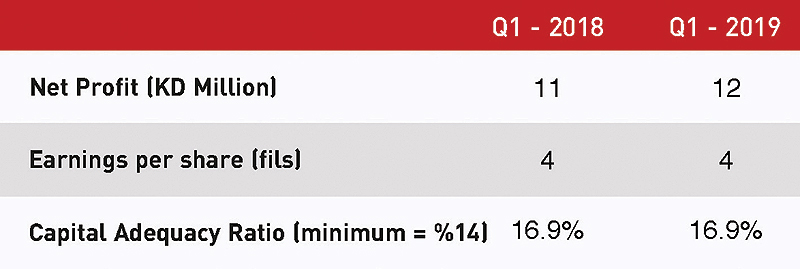

Net profit grows 9% in Q1 2019 vs Q1 2018* Total assets increase to KD 5.8bn

KUWAIT: Gulf Bank K.S.C.P. ("The Bank") recorded a net profit of KD 11.8 million in the first quarter of 2019, an increase of 9 percent over the same quarter in 2018. The Bank's return on assets improved from 0.77 percent in the first quarter of 2018 to 0.81 percent and return on equity grew from 7.4 percent to 7.7 percent.

Compared with 31st March 2018, total assets increased by 2.3 percent to KD 5.8 billion, loans and advances to customers climbed 1.8 percent to KD 3.9 billion, customer deposits grew by 1.1 percent to KD 3.6 billion, and shareholders' equity increased by 4.8 percent to KD 614 million.

The improvement in Net profit was driven primarily by lower credit provisions / impairments of KD 8.0 million offset by lower non-interest income of KD 1.8 million, higher staff expenses of KD 1.8 million, higher depreciation expense of KD 0.8 million, and a KD 2.8 million provision related to a service disruption that was previously disclosed.

Commenting on the results, Omar Kutayba Alghanim, Gulf Bank's Chairman said: "I'm pleased to announce that the Bank started the year positively with an increase of 9 percent in our first quarter net profit compared to the same period of last year. I am also happy to inform our investors about the inclusion of Gulf Bank shares within the FTSE-Russel emerging markets index during its March review. This inclusion will attract more regional and international investors to support the liquidity and attractiveness of Gulf Bank's shares."

On March 11th, 2019, Gulf Bank held its Annual General Meeting and obtained approval from its shareholders to pay cash dividends of 10 fils per share.

"A" credit ratings

Gulf Bank continues to be well recognized in terms of its credit worthiness and financial strength internationally as it is rated "A" by all four leading credit rating agencies.

Fitch: "A+" rating with a "Stable" outlook

S&P Global Ratings: "A-" rating with a "Stable" Outlook

Moody's Investor Services: "A3" rating with a "Positive" Outlook

Capital Intelligence: "A-" rating with a "Stable" outlook.

Corporate activities

During the first quarter of 2019, Gulf Bank held several corporate activities. At the start of the year, the Bank held its annual draw for its Al-Danah account at The Avenues Mall, awarding a lucky winner with the grand prize of KD 1,000,000. A similar youth-driven event was held at The Murouj complex for its Kuwaiti Salary account holders and another lucky customer won a total of KD 250,000. Moreover, Gulf Bank hosted its second annual WISE Investment Forum at the Four Seasons hotel Kuwait and discussed with its guests global and regional market outlook for 2019.

As part of its commitment to empowering the youth of Kuwait, and the continued Kuwaitization of the private sector, Gulf Bank was the Platinum Sponsor of the 2019 edition of the Manpower and Government Restructuring Program (MGRP) Career Fair during which the Bank conducted on the ground screenings, as well as interviews of potential employees offering employment contracts to Kuwaitis on the same day. In line with the same commitment, Gulf Bank showcased a first-of- its-kind virtual recruitment experience at the 21st edition of Gulf University for Science and Technology's (GUST) Career Fair.

Commenting on the bank's continued commitment to social responsibility, Alghanim said, "This year, we're determined to continue our drive for sustainability by supporting initiatives focused on youth, health and environment." Sustainability has taken a lead in Gulf Bank's success and continued to play an integral role in its corporate social responsibility initiatives. The Bank's participation in the Qout Market highlighted its focus on the environment by hosting a unique planting workshop. In addition, Gulf Bank set up an innovative outdoor recycling station to encourage recycling. The Bank also joined the Global Earth Hour movement, highlighting the issue of climate change by going dark and turning off all unnecessary lighting at its Head Office and several of its branches.

Appreciation

Alghanim continued to say, "I would like to thank everyone that contributed to these results. I'd also like to convey my deepest appreciation to our shareholders and the Central Bank of Kuwait for their continued support. I especially want to thank our customers for their loyalty and reiterate our commitment to place them at the center of everything we do."

Gulf Bank is one of the leading conventional banks in Kuwait with total assets of KD 5.8 billion for year ended 31 March 2019. The Bank provides a broad offering of consumer banking, wholesale banking, treasury, and financial services through its large network of 58 branches and more than 200 ATMs in Kuwait. The Bank was founded in 1960 and is listed on the Kuwait Stock Exchange (Boursa Kuwait) since 1984.