Geopolitical tensions cast shadow on economic outlook - Issuance in GCC picked up in Q3 2107

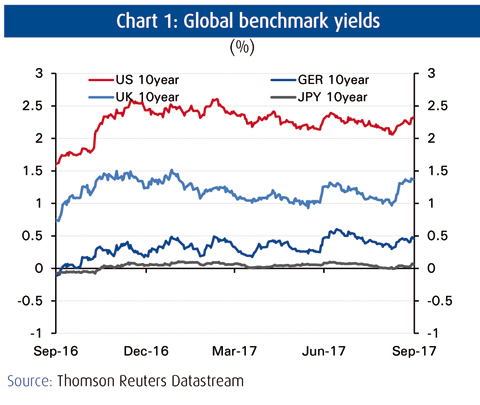

KUWAIT: Global and GCC debt markets yields traded in a narrow range in 3Q17 as central banks' increased hawkishness and the improving economic outlook were countered by geopolitical tensions, White House political challenges and stubbornly low inflation. Issuance in the GCC picked up in 3Q17 but continued to be dominated by domestic sovereign issuance; Bahrain was the only country to issue internationally. GCC primary debt market activity is expected to stay healthy for the remainder of 2017.International benchmark yields trended downward for most of the quarter as North Korea worries benefitted safe haven assets. Persistently low inflation in the major economies also continued to put a cap on yields. However, most yields ended the quarter slightly higher following a more hawkish tone by Fed Chair Janet Yellen and the unveiling of President Trump's pro-business tax plan late in the quarter.

Risk off mode

US government 10-year Treasury yields trended lower for most of 3Q17 but finished 2 bps higher at 2.3 percent. Tensions with North Korea spurred a generally "risk-off" mode, exerting downward pressure on yields. Demand for safe-haven assets also picked up as hurricanes hit the US coast. But yields recovered shortly after as the impact turned out to be less than was previously feared. Yields took a detour thereafter, pushed higher mostly by the Fed's more hawkish stance. Towards the close of the quarter, yields shot up as investors digested the latest iteration of Trump's tax plan and Yellen's unwavering pursuit of monetary tightening. Market expectations for a rate hike in December rose to 80 percent from 25 percent just a few weeks earlier following September's FOMC meeting in which they announced the start of the balance sheet reduction process.

Yields on 10-year German Bunds followed a similar path. Despite the continued flow of economic data highlighting the strength in the Eurozone economy, inflation data was still surprising on the downside, putting downward pressure on yields.

The North Korean threat also saw Bund yields move lower along with other safe-havens. The German election was another factor pulling yields lower in 3Q17. Although Angela Merkel's party won the election, the results were perceived as weak given the strong showing by the far-right party. Nonetheless, yields on German paper ended the quarter unchanged at 0.46 percent thanks to a more hawkish European Central Bank (ECB). Indications by ECB President Mario Draghi that winding down the bank's EUR 60 billion monthly asset purchases would be discussed at the October meeting saw Bund yields jump.

The spread between the 10-year Treasury yield and the 10-year Bund continued to tighten. The spread had widened to 2.4 percent following the election of President Trump in November. His pro-business agenda, coupled with the markets' improved prospects for the US economy, pushed US equities and yields higher. At the same time, German yields were edging lower as Brexit and rising anti-EU sentiment fueled concerns over the future of the EU. But spreads have tightened considerably since and are now hovering around 1.8 percent as US markets discounted expectations of imminent pro-business reforms and pro-EU parties advanced across the Eurozone. Eurozone growth has also gained momentum over the past few quarters, prompting a shift in the ECB tone as it sought to begin winding down its quantitative easing program.

GCC yields

GCC yields tracked international markets and closed the quarter slightly lower. The quarter saw a marked improvement in oil prices which also helped GCC yields move lower. Oil prices were up 25 percent in 3Q17, increasing the appeal of regional paper as fiscal concerns were alleviated. Most GCC sovereign yields were marginally down on the quarter.

Yields on Qatari and Omani sovereign bonds dropped more notably following the sell-off seen in 2Q17. After reaching a high of 3.3 percent on the back of its political rift with its neighbors, yields on Qatar's bonds maturing in 2021 fell to 2.8 percent at the close of 3Q17. Yields on Omani paper maturing in 2021 also declined in 3Q17 to end at 3.5 percent after having reached 3.9 percent in the previous quarter following the sovereign's downgrade to below investment-grade by S&P.

GCC debt issuance picked up in 3Q17 as the typically slower summer season came to an end but activity remained predominantly in the public sector. Total new issuance amounted to $24 billion compared to $21 billion in 2Q17. Private sector activity continued to weaken in 3Q17, with the share of sovereign issuances up to 94 percent. Total outstanding debt was up a healthy $20 billion, to rest at $415 billion.

Sovereign activity was strong during 3Q17 with $23 billion in new issuances and the bulk coming from Saudi Arabia. Bahrain tapped international markets for the second time this year with a $3 billion issuance. Despite Bahrain having a rating below investment-grade by the three main rating agencies, the offering was well received and almost five times oversubscribed, reflecting the strong appetite and increased attractiveness of the regional debt market. Saudi Arabia and Kuwait issued domestic debt of $11 billion and $4 billion, respectively.

Following the sharp increase in CDS rates on the back of Qatar's dispute with its neighbors, CDS rates for most of the tracked sovereign's came off in 3Q17. For the most part, the region's risk profile benefited from the recovery in oil prices. CDS rates for Saudi Arabia and Qatar dropped the most, by 31 bps and 22 bps, respectively. As for the rest of the GCC, their rates were little changed.

GCC debt issuance is expected to remain healthy in 4Q17, as sovereigns continue to seek cheap deficit financing in favorable market conditions. In early October Saudi Arabia raised $12 billion in dollar-denominated debt almost a year after its debut international issuance. Abu Dhabi also just completed a $10 billion international offering.

NBK ECONOMIC REPORT