Lower oil prices expected in 2019-20 as OPEC bids to rebalance market

KUWAIT: This edition of the MENA Outlook occurs against a backdrop of increased global economic uncertainty and financial market volatility. The IMF, in its October 2018 WEO, revised down its global economic outlook by 0.2 percent to peg world output growth at roughly 3.7 percent over the next two years, a decent enough pace, but noted that the balance of risks is tilted to the downside. These are dominated by escalating trade protectionism, which has been sparked by the unresolved US-China trade tariff dispute and continued US monetary tightening-the US Federal Reserve hiked rates four times, by 25 bps each time, in 2018-with ramifications for emerging market economies and those with currencies pegged to the US dollar in terms of increased capital outflows and higher borrowing costs.

Policymaking uncertainty, at least in advanced economies, is further complicating the picture. From the Trump administration's partial shutdown of the federal government and likelihood of further legislative impasse in the face of a Democrat-controlled congress to the UK's Brexit woes and President Macron of France's tax reversal in the face of the 'gilet jaunes' (yellow vests) street protests, 2018 ended on a bad note.

The financial markets plunged into bear territory during the last quarter of 2018, with the S&P 500 and MSCI EM indices closing the year down 6.2 percent and 12.3 percent, respectively. GCC stock indices, in comparison, fared relatively well, with Saudi's Tadawul gaining 8 percent, Abu Dhabi's ADX 11.7 percent and Qatar's QE a region-leading 20.8 percent (though from a low base).

Oil prices

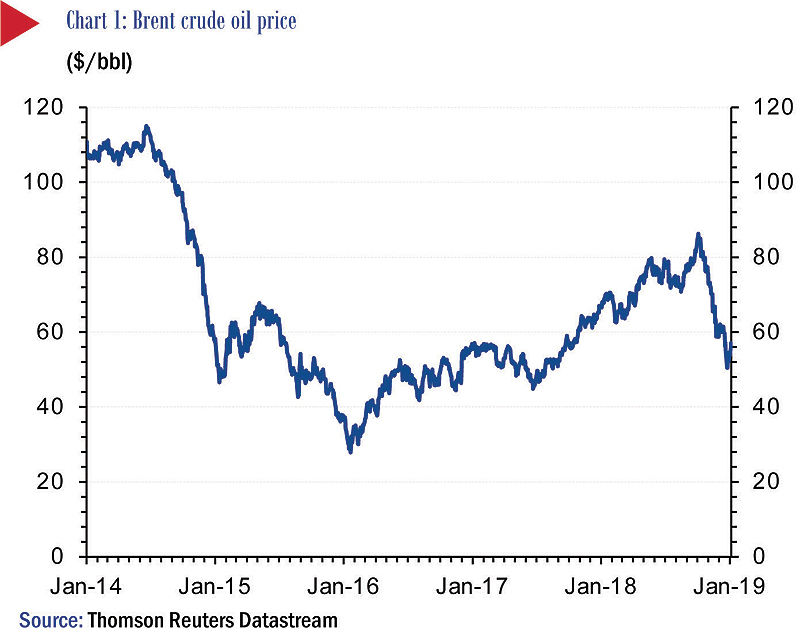

The outlook for oil prices has changed considerably over the last six months, with the balance of risks in 2019-2020 skewed to the downside. We envisage prices (Brent) averaging $65/bbl in 2019 and 2020, down from 2018's average of $71.6/bbl. Amid a mélange of bearish catalysts, from rampant US shale production and burgeoning OPEC+ output to President Trump's decision to offer six-month sanctions waivers to Iran's largest customers and weakening global economic growth, Brent crude, the international benchmark, plunged almost 38 percent in the last three months of 2018 to $54/bbl by year's end. Brent had been as high as $86/bbl in early October. Oil's price drop prompted OPEC to reconvene in December and reinstitute production cuts of at least 1.2 mb/d for 2019 in order to stabilize oil prices.

GCC growth

For the GCC oil producers, with the likely exception of Qatar, the softer oil price outlook for 2019-2020, coupled with production cuts, will likely delay the process of fiscal balancing and, in the process, place added pressure on the non-oil sectors to drive revenue growth and real output gains. Qatar's decision last December to withdraw from OPEC frees it from production cut obligations, while its fiscal account (and current account) was on track in 2018 to record a first surplus in three years.

Regional governments will continue with their ambitious infrastructure and development projects, backed by expansive public spending plans, with Saudi Arabia's record SR1.1 trillion ($293bn) budget the most eye-catching.

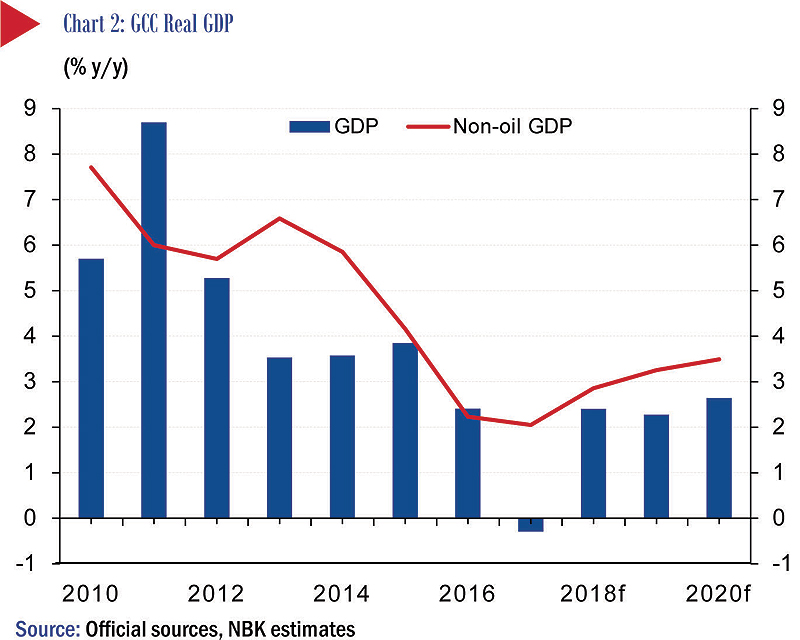

Private sector stimulus programs and productive infrastructure investments will, by and large, support non-oil growth over the forecast period. Reforms to stimulate the business environment and incentives to attract long term foreign investment were also introduced, most notably in the UAE, which reduced fees in several sectors, including real estate and tourism (Dubai), offered mainland licenses for businesses operating in free trade zones (Abu Dhabi) and, at the federal level, approved the issuance of residency visas to skilled expatriates for up to ten years and raised foreign ownership limits of companies operating outside of free trade zones to 100 percent from 49 percent. We expect GCC non-oil growth to improve from 2.9 percent in 2018 to 3.3 percent in 2019 and 3.5 percent in 2020.

On the hydrocarbon side, GCC governments' oil and gas expansion plans will continue apace, despite OPEC+ production cut obligations and the prospect of lower oil prices. The UAE is on the verge of meeting its oil production capacity target of 3.5 mb/d, having identified close to $145bn of new upstream and downstream investments over the next five years.

Both Qatar and Bahrain have commenced projects to significantly increase their oil and gas output-Bahrain after discovering sizeable offshore tight oil and gas deposits and Qatar after deciding to expand LNG production capacity by 43 percent to 110 mtpa. Kuwait, for its part, intends to capitalize on its burgeoning non-associated gas production and light condensate output-it sold its first shipment of the super light crude, which isn't subject to OPEC+ quotas, in 3Q18-and forthcoming expanded refinery capacity, with the $12bn Clean Fuels Project close to completion.

Apart from oil prices, risks to the outlook include still-lackluster credit growth in an environment of rising costs of borrowing linked to US monetary tightening (especially in the case of Saudi Arabia) and lower oil prices with their impact on consumers' confidence and spending. Overall, we expect headline growth in the GCC to average 2.3 percent in 2019 and 2.6 percent in 2020, from an estimated 2.4 percent in 2018.

Inflationary impulses, meanwhile, appear to be restrained, weighed down by falling real estate/rental prices and still-subdued demand. The introduction of VAT in the UAE and Saudi Arabia in 2018 was the predominant contributor to the increase in prices in those countries, but its effects have worn off. Inflation should rise by no more than 2.0 percent by 2020.

Reforms boost Egypt's economy

In Egypt, economic growth has been relatively strong, reaching 5.3 percent in 2017/18 and supported by IMF funds and associated fiscal reform measures, which have also trimmed the deficit. Tourism and exports are recovering, helped in part by a cheaper currency, remittances have increased substantially, and unemployment has begun to fall (to 10 percent in 3Q18 from 11.9 percent in 3Q17). We expect growth to continue at roughly the same rate over the forecast period, supported by investment spending, gains in the tourism sector and continued increases in natural gas production.

NBK Economic Report