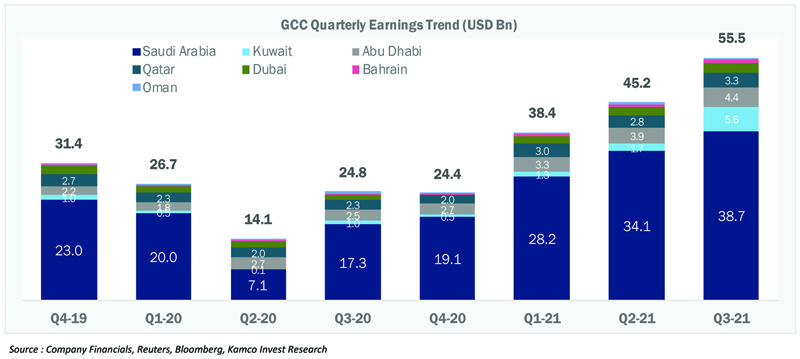

KUWAIT: Aggregate net profits reported by companies listed on GCC exchanges reached a new record high during Q3-21 at $55.5bn, an increase of 123.4% y-o-y and 22.7% q-o-q. The increase reflected positive earnings growth across the seven exchanges in the region with Kuwait leading during the quarter led by an aggregate net profit of $5.6bn, an increase of almost six folds. Profits for Saudi Arabia, Dubai and Bahraini companies also more than doubled during the quarter, whereas Omani companies reported only marginal growth of 1.2%.

Higher profitability reflected accelerated economic activity in the region with the PMI figures for Saudi Arabia and UAE consistently and comfortably above the growth mark of 50 at 57.7 and 55.7 during October-21, respectively. The COVID-19 pandemic has largely remained under control over the last few months with declining cases as well as due to a fast paced vaccination effort in the GCC. As a result, bulk of the economic sectors are back at pre-pandemic capacities barring a few that include tourism and hospitality sectors.

The sector performance chart once again saw a repeat of last quarter with energy, banks and materials companies leading the quarterly net profit growth. The transportation sector was next with a net profit of $3.34bn in Q3-2021 vs 0.04 bn in Q3-2020. The increase in profits was mainly led by Agility that reported net profits of $3.1bn during the quarter mainly due to a gain on sale of its logistics unit to DSV Panalpina. On the other hand, the telecom sector reported a y-o-y fall in profits mainly led by a steep drop in profits reported by Ooredoo and Du.

Net profits for 9M-2021 more than doubled to $139.1bn as compared to $65.6bn during 9M-2020. The increase was mainly led by higher profits reported by Saudi Arabian companies with a net profit growth of 127.5% to reach $101.0bn in 9M-2021 vs $44.4bn in 9M-2020 followed by Abu Dhabi and Qatar with net profits reaching $11.6bn and $9.1bn, respectively.

The resumption of economic activity in the GCC to almost full scale was reflected in corporate profits booked during Q2-2021. Aggregate profits during the quarter breached pre-COVID levels to reach $45.0bn during Q2-2021 vs. $14.2bn during Q2-2020. The sequential growth in net profit was also healthy at 17.6% as a majority of the sectors posted growth as compared to last year.

Saudi Arabian companies reported the biggest absolute increase in earnings that rose by $26.5bn or 356.6% y-o-y to reach $33.9bn during Q2-2021. Quarterly net profit of Saudi Aramco was up 258.3% y-o-y to reach $24.2bn mainly backed by higher oil and other commodity prices globally during the quarter. Companies in Kuwait also reported multi-fold increase in quarterly profits from a record low profit last year, whereas Abu Dhabi-listed companies posted a profit growth of 49%. Omani companies reported the smallest y-o-y increase in earnings during the quarter at 22.3% to reach $0.52bn.

In terms of sector performance, the energy sector once again led the y-o-y rise in earnings posting $24.5bn or 267.4% y-o-y jump in earnings up from $6.7bn in Q2-2020. Profits for the banking sector almost doubled y-o-y to $8.2bn during Q2-2021. Companies in the materials sector posted profits during Q2-2021 to the tune of $4.3bn as compared to a net loss of $0.78bn during Q2-2020.

On the other hand, sectors that were resilient during the pandemic witnessed a y-o-y decline in profits. Telecom was the one of the four sectors that posted a y-o-y decline with profits reaching $1.64bn during Q2-2021, a decline of 11.6% y-o-y and 18.6% q-o-q. Insurance, Retailing and Food & Staples Retailing sectors also posted marginal y-o-y decline in profits during Q2-2021. Insurers in Saudi Arabia posted the biggest y-o-y decline in earnings during Q2-2021 with profits more than halved to $118mn during the quarter as compared to $253mn during Q2-2020.

Earnings reported by GCC-listed companies witnessed a faster-than-expected recovery during Q1-2021 backed by healthy growth seen in almost all sectors. The recovery was led by a resumption in economic activity in the region despite controlled restrictions as COVID-19 cases remerged at the start of the year resulting in partial-lockdowns. Business sentiments have remained upbeat as a result of one of the fastest vaccine administration in the world achieved by the GCC countries.

This was also reflected in the monthly PMI, which indicates trends in manufacturing activity, for Saudi Arabia and UAE. According to Markit, Saudi Arabia's PMI in January-2021 was at 57.1, the highest since November-19 and remained elevated above the 50 mark during February-2021 and March-2021. Similarly, the PMI for UAE also remained above 50 during the first three months of this year. A PMI of above 50 indicates growth in manufacturing activity.

Quarterly net profits reached $40.0bn during Q1-2021, up 49.2% or $13.2bn as compared to $26.8bn reported in Q1-2020. Earnings during the quarter also surpassed Q1-2019 level by 4.4%. The q-o-q growth as compared to Q4-2020 was even stronger at 59.9%. Out of the 21 sectors on the exchange, 17 sectors reported y-o-y as well as q-o-q growth in profits during Q1-2021. Moreover, the top 5 sectors in the region reported a y-o-y profit growth of 42% with the bulk of the growth coming from the materials sector.

On the other hand, the three sectors that reported y-o-y decline in profits included Consumer Services, Food & Staples Retailing and Software & Services. Companies in the Food & Staples Retailing and Software & Services sectors reported smaller profits due to a higher base in Q1-2020 that resulted in a decline in Q1-2021, whereas the decline in the Consumer Services sector was mainly led by losses reported by companies that continue to be affected by COVID-19 restrictions, including airlines and related industries.

In terms of sequential growth, excluding Bahraini companies, the growth in net profit was almost 80% or an absolute growth of $10.9bn to reach $25.1bn in Q3-2020. The biggest q-o-q growth was seen in the energy sector with the profits up by $4.9bn or 72.9% to reach $11.5bn. The banking sector was next with a profit growth of 66.9% after banks reported higher topline coupled with a decline in provisions that supported earnings. The materials sector reported profits of $634.5mn during the quarter as compared to losses during Q2-2020. On the other hand, the Insurance and Real Estate sectors reported the biggest q-o-q decline in earnings at 36.8% and 22.4%, respectively.

Earnings performance when compared to last year was broadly negative with a decline of 34.5% in Q3-2020 with steep declines is some of the key large-cap sectors on the GCC exchanges. Saudi Arabian companies reported the biggest absolute decline in earnings that fell by $10.2bn or 37.0 % y-o-y to reach $17.4bn during Q3-2020. Excluding the quarterly net profit of Saudi Aramco that declined by 44.5% y-o-y, aggregate profits for Saudi Arabia declined at a much smaller pace of 11.9% y-o-y. Companies in Dubai and Kuwait were next with declines of $1.8bn and $430.6mn, corresponding to y-o-y percentage declines of 59.2% and 30.4%, respectively. Companies listed in Abu Dhabi reported the smallest q-o-q decline in earnings at 2.9% to reach $2.39bn.

November-2021

The Energy sector reported the biggest absolute profits in the GCC that reached $29.7bn, more than double y-o-y and 19.2% q-o-q. Profits for Saudi Aramco was up 146.3% y-o-y during Q3-2021 at $29.1bn, whereas the rest of the companies in the sector reported profits of $596.1mn in Q3-2021 as compared to a loss of $145.4mn in Q3-2020. Profits for Aramco was supported by higher crude oil prices led by recovery in oil demand globally coupled with higher output during the quarter. In terms of segments, results also got a boost from improved refining and chemicals margins during the quarter. Sectors peers like Dana Gas and Al Rabigh Refining reported profits during Q3-2021 mainly led by higher revenues as compared to losses during Q3-2020.

The banking sector also reported higher profits during Q3-2021 that reached $9.6bn, an increase of 36.1% y-o-y and 17.1% q-o-q. The y-o-y growth in profits was seen across the region after a steep decline in profits reported last year. Dubai-listed banks reported more than two fold increase in net profits in Q3-2021 followed by Kuwait and Bahrain listed banks. Saudi-listed banks posted profit growth of 24.3% y-o-y and 21.3% q-o-q and accounted for 37% of the sector profits during the quarter.

Profits for the materials sector stood at $3.9bn during Q3-2021 as compared to a profit of $0.7bn in Q3-2020. However, profits declined as compared to Q2-2021 by 13.0% mainly on the back of smaller q-o-q profits reported by Materials companies listed on Saudi Arabia and Kuwait. The q-o-q decline was mainly led by higher input costs that led to lower profits for sector majors like SABIC and Yanbu National Petrochemicals. SABIC also reported a 2% q-o-q decline in volumes during Q3-2021 which was more than offset by higher selling prices.

For the Telecom sector, aggregate net profits during Q3-2021 was affected by y-o-y decline reported by 6 out of 17 listed companies in the sector. Ooredoo's profit declined from $176.7mn in Q3-2020 to $53.7mn in Q3-2021 despite higher revenues mainly led by forex losses.

Net profits during 1H-2021 more than doubled to $83.2bn as compared to $41.0 bn during 1H-2020. Profits were once again up across the board as compared to the peak of the pandemic period last year. Saudi Arabian companies posted a profit growth of 125% y-o-y during 1H-2021 with Aramco posting a profit growth of 90.7%. Excluding Aramco, profit for Saudi-listed stocks increased more than four-fold to $16.8bn during 1H-2021.

In terms of sector performance, profits for the energy sector almost doubled while banks posted an increase of 47.2% during 1H-2021. Materials and utilities companies also posted healthy profits during 1H-2021 as compared to losses during 1H-2020 for both the sectors.

The Telecom sector, which reported limited impact from the lockdowns reported a marginal y-o-y net profit decline of 0.8% wit profits at $2.2bn in Q1-2021, although q-o-q growth was strong at 34.4%. Out of 16 listed telcos in the GCC, 8 reported a y-o-y decline in profits that were partially offset by healthy growth in profits for Etisalat and Mobily.

In terms of 9M-2020 earnings performance, the aggregate for the GCC countries declined by 44.1% y-o-y to reach $65.3bn as compared to $116.8bn during 9M-2019, a decline of $51.5bn. Saudi Arabia once again reported the biggest absolute decline in earnings with a fall of $39.9bn or 46.9% to reach $45.2 bn. Dubai was next with a decline of $4.5bn or 52.2% to reach $4.1bn in aggregate 9M-2020 earnings. Kuwait and Abu Dhabi also witnessed steep absolute decline in earnings during the period, falling by $3.2bn and $1.9 bn, respectively. The smallest percentage decline was reported by Oman at 16.2% or $0.2bn to reach $1.2bn in 9M-2020.

The y-o-y decline in quarterly earnings for the Energy sector came primarily on the back of subdued oil prices during the quarter that pushed down earnings across the board for the sector. Both crude oil and natural gas prices remained range bound during the quarter. Aramco's Q3-2020 earnings showed strong q-o-q recovery in Q3-2020 with a growth of $5.0Bn or 74.5% on the back of recovery in oil prices although average crude production in Q3-2020 was almost 0.5 mb/d lower in Saudi Arabia as compared to Q2-2020 production.

However, in terms of y-o-y performance, Aramco's profits plunged by 44.5% or $9.5Bn, a trend seen in 15 out of the 21 energy companies that declared Q3-2020 earnings. In the Materials sector, SABIC reported profits for the first time in four quarters at $290.2mn, a y-o-y growth of 30.5% led by higher sales volumes and improved margins.

Net profit for the GCC banking sector bottomed in Q2-2020 and witnessed a strong revival in Q3-2020 growing by 66.9% q-o-q to $7.3bn, although it continues to remain well below pre-covid levels with a decline of 26.9% vs. Q3-19. The q-o-q growth was mainly led by a fall in provisions during the quarter as well as savings on cost of fund. An increase in non-interest income also contributed to the growth in quarterly profits. Profits for Saudi Arabian and Kuwaiti banks witnessed multifold q-o-q increase during Q3-2020, while the sector reported a decline in all the GCC countries in terms of y-o-y performance.

Aggregate net income for listed banks reached one of the lowest on record during Q2-2020 after declining by 32.9% y-o-y to reach $6.1bn. The decline was broad-based with the banking sector in all of the six exchanges (excluding Bahrain) reported double-digit drop in net profits during Q2-2020 led by provisions charges related to covid-19.

Telecom sector earnings declined by 8.2% y-o-y and 4.6% q-o-q during Q2-2020 to reach $1.81bn. The decline came after 12 out of 15 listed telcos reported a y-o-y fall in earnings. The biggest absolute y-o-y decline in earnings was reported by UAE's Du with its net profits declining by $67.7mn or 53.6% to reach $58.6mn due to a lockdown-led decline in the telco's topline. Zain and STC were next with declines of $46.4mn (-28%) and $33.0mn (-4.3%). Etisalat and Ooredoo were the only regional operators that reported a y-o-y earnings growth of 7% and 2.6%, respectively, during Q2-2020.

.jpg)