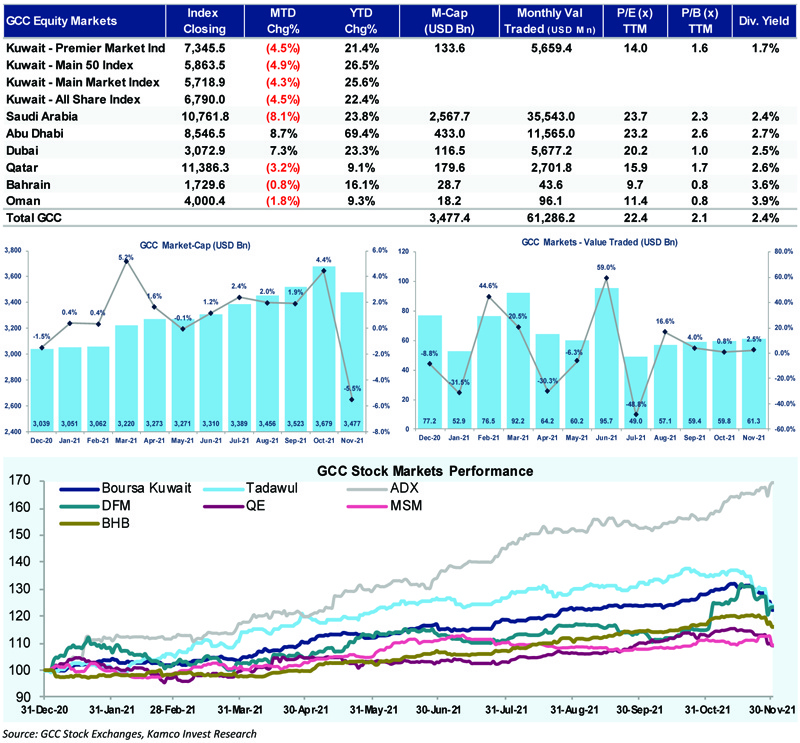

KUWAIT: GCC markets declined for the first time in 13 months in November-2021 as the new COVID-19 variant, Omicron, sent shockwaves across financial markets globally. The MSCI GCC index dropped 4.7 percent during the month, in line with most major exchanges globally. In terms of market-cap, total value of listed stocks in the region declined by $205 billion to reach $3.5 trillion by the end of the month. The monthly decline during November-2021 dented the performance of GCC markets since the start of the year which now stands at 29.7 percent.

Within the GCC, Abu Dhabi and Dubai exchanges remained largely resilient to the global pressure, although even these markets were not spared on 28-November-2021, which saw steep global single day sell-off, with declines of 1.8 percent and 5.2 percent. Most GCC markets reported a decline during November-2021, barring ADX and DFM that reported a gain of 8.7 percent and 7.3 percent, respectively. Saudi Arabia's TASI reported the biggest decline of 8.1 percent losing almost $240.3 billion in market-cap during the month.

The decline highlighted the impact of the slide in oil prices to below $70/b mark, although briefly. The month also saw Abu Dhabi further strengthening its global lead in terms of market performance since the start of the year with a return of 69.4 percent, one of the highest globally. Dubai also scaled up to be the third best performing market in the GCC with a YTD-21 return of 23.3 percent. On the other hand, Saudi Arabia remained the second ranked market in the GCC, but with a smaller lead over Dubai with a gain of 23.8 percent.

The GCC sector performance chart showed declines across the board during November 2021 with the exception of Diversified Financials and Telecom indices that reported gains of 5.3 percent and 4.2 percent, respectively, while Real Estate was almost flat with a gain of 0.1 percent. Consumer Durable & Apparel was the biggest decliner with a monthly fall of 21.5 percent followed by Utilities and Pharma & Biotech indices with declines of 13.5 percent and 12.4 percent, respectively.

Boursa Kuwait

Kuwaiti benchmarks receded during November-2021 with the second-biggest drop during the month following a broad-based decline that affected most markets in the region as well as globally. In terms of market segments, the Main 50 Index witnessed the biggest monthly decline of 4.9 percent as performance of constituent stocks in the index were skewed downwards. The Premier Market Index and the All-Share Market Index reported a monthly decline of 4.5 percent followed by the Main Market index that receded 4.3 percent during November-2021. With the declines, Kuwait lost one spot in terms of YTD-2021 returns and now ranks at the fourth position with a return of 22.4 percent for the All Share Index. The Main 50 Index was up 26.5 percent vs. 21.4 percent gains for the Premier Market Index.

The sector performance chart also highlighted the broader decline in the market with merely two indices, Insurance and Health Care, showing gains of 7.6 percent and 1.8 percent, respectively, during the month. The Basic Materials Index was the biggest decliner with a double-digit decline of 10.4 percent followed by the Industrials and Financial Services indices with declines of 7.0 percent and 6.2 percent, respectively. Large-cap indices like Banking and Telecom witnessed mid-single digit declines. The Banking sector index was down by 3.8 percent during the month after shares of 9 out of ten Kuwaiti banks declined. The Telecom index declined by 4.3 percent reflecting decline in 4 out of 5 constituent stocks in the index. Shares of all the three telecom providers dropped during the month with Zain leading with a decline of 5.0 percent.

In terms of monthly stock performance, Credit Rating & Collection Co topped the chart with a gain of 96.4 percent followed by Umm Al-Qaiwain General Investments Co and Jiyad Holding Co with gains of 28.6 percent and 28.4 percent, respectively. On the decliners side, MENA Real Estate Co topped with a fall of 47.0 percent followed by National Co for Consumer Industries and Salbookh Trading Co with the declines of 38.4 percent and 27.5 percent, respectively.

Trading activity remained upbeat during the month with the total volume of shares traded during the month was the highest since January-2017 and increased by 14.8 percent m-o-m to 10.7 billion shares as compared to 9.3 billion shares traded during Oct-2021.

Monthly value traded witnessed an increase of 36.8 percent to reach KD 1.7 billion in November-2021 as compared to KD 1.25 billion in Oct-2021. GFH Financial Group topped the monthly value traded chart with KD 163.5 million worth of shares traded followed by KFH and NBK at KD 142.1 million and KD 122.7 million, respectively. On the monthly volume chart, GFH Financial Group.

Saudi Arabia (Tadawul)

After witnessing gains for ten consecutive months, the Saudi Stock Exchange reported a steep decline during November -2021 led by a global sell-off triggered by a new variant of COVID-19. The index closed the month below the 11,000 mark for the first time since July-2021 at 10,761.8 points, witnessing a monthly decline of 8.1 percent. The new COVID-19 variant further affected oil market sentiments that was already low owing to the release of SPR by the US government during the last week of the month.

Brent futures traded near the $70/b mark after declining by more than 17 percent from its peak of over $86/b seen during the last week of October-2021. The decline in TASI also affected the benchmark's YTD-21 performance which now stands at 23.8 percent, marginally above the third ranked exchange in the region.

Abu Dhabi Securities Exchange

Abu Dhabi Exchange reported the best monthly performance during November-2021 despite declines towards the close of the month. The index surged for the fourteenth consecutive month and registered a gain of 8.7 percent to close at 8,546.52 points. With consecutive positive performance since the start of the year, the ADX index showed one of the highest returns globally at 69.4 percent.

The monthly sector performance chart remained mixed but was skewed towards gainers with six out of the nine sectors recording gains during the month. The Telecom index led the way registering 24.1 percent gain during the month mainly led by gain in shares of Emirates Telecom Corp that was up 24.8 percent during the month followed by Sudan Telecommunication Company which saw a 10.6 percent increase in its share prices.

Dubai Financial Market

The DFM index rose significantly into positive territory during November-2021 and was second-best performing market during the month after ADX. The benchmark witnessed a gain of 7.3 percent during the month and closed at 3,072.9 points after a marginal 0.7 percent monthly decline in October-2021. Gains came mainly on the back of the news that Dubai government plans to list as much as ten state-owned firms in Dubai Stock Exchange.

In terms of YTD-21 performance, the index showed returns of 23.3 percent at the end of November-2021, the third highest in the GCC after ADX and TASI. In terms of sector performance, five out of nine sectoral indices dipped into the red during the month, however, the Financial and Investment Services index jumped 37.3 percent.

Qatar Exchange

After reaching multi-year high levels during October-2021, the QE 20 Index reported the third-biggest m-o-m decline during November-2021. The index closed the month at 11,386.31 points registering a decline of 3.2 percent. The Qatar All Share Index also reported a decline of 3.2 percent, indicating a broad-based weakness in the market. With the decline during Nov-2021, the YTD-2021 returns for the QE 20 index was slashed to 9.1 percent, one of the lowest performance in the GCC. Comparatively, the QE All Share index reported a relatively higher YTD-21 growth of 12.8 percent.

Bahrain Bourse

Bahrain All Share index dipped into the red, albeit marginally, during November-2021 led by a broad-based decline. The index fell 0.8 percent during the month to close at 1,729.6 points after gains at the start of the month was completely wiped off by the end of the month. The index was in the green until the last trading day, but a decline of 1.4 percent on 30-November-2021 pushed MTD gains in the red. In terms of YTD-21 performance, the index is up 16.1 percent for the first eleven months of the year, ranking fifth in the GCC.

Muscat Securities Market

The Omani stock market recorded 1.8 percent decline during November-2021 after witnessing 3.4 percent gain during October-2021. The MSX index closed slightly above the 4,000 mark at 4,000.35 points after consistent declines at the start of the month was only partially offset by gains during the second half. In terms of YTD-21 performance, the MSX index was up 9.3 percent this year making it the second-lowest gaining market in the GCC this year.

In terms of sector performance, all the three main sectors of the exchange fell into negative territory during November-2021.The Services Sector index fell 3.6 percent during the month whereas the Industrial and Financial indices reported declines of 2.4 percent and 0.5 percent, respectively.