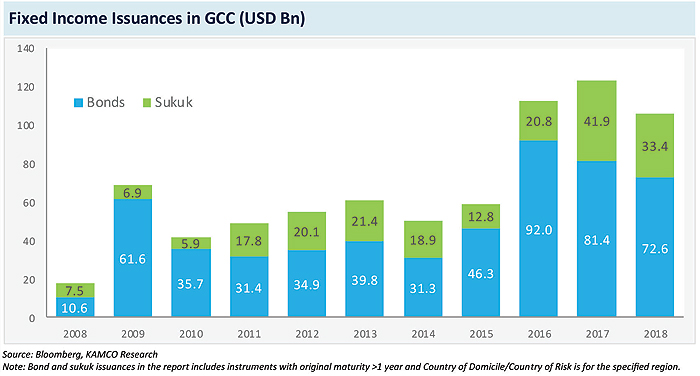

Bonds and sukuk issuances declined 14.1% in 2018 to reach $105.9 billion

KUWAIT: After three consecutive years of growth and record issuances in 2017, the GCC fixed income primary market took a breather, as bonds and sukuk issuances declined 14.1 percent in 2018 to reach $105.9 billion.

Government issuance during the year declined almost a third but was partially offset by almost 20 percent increase in corporate issuances. Issuances in the broader MENA region also declined during the year by 16 percent to $145 billion as compared to $173 billion during 2017 primarily due to lower bond issuances in non-GCC MENA countries.

The trends in the oil market had a visible impact on both government and corporate issuances in the region. The y-o-y increase in average oil prices in 2018 vs. 2017 supported state coffers, resulting in minimal external finance requirement to support the largely unaffected state spending plans, although the steep decline towards the end of the year prompted a more cautious and conservative outlook for the near term.

According to KAMCO Research calculations and IMF data, deficits for the GCC region in 2018 are now forecasted to reduce to $14 billion (-0.9 percent of GDP), an 82 percent reduction from 2017 budget deficits ($79 billion), based on our analysis of IMF's general government fiscal balance estimates. Corporate issuers in the region remained upbeat with higher bonds and sukuk issuances during the year. GCC corporates raised $47.2 billion during the year via bonds and sukuks as compared to $39.5 billion during 2017 with majority of them boasting a 'Stable' outlook from rating agencies. In addition, the volatility in the regional equity markets also favored higher issuances in the debt market. Firms took advantage of lower rates as the US Fed raised rates four times during 2018 and most of these rates were passed on by GCC regulators due to the pegged currencies for five out of the six GCC economies.

On the other hand, the rising interest rates environment globally also resulted in lower returns for bond investors although the impact was blunted for the GCC instruments after GCC countries became a part of the JP Morgan Bond indexes during the year. The inclusion increased the demand for regional instruments by foreign investors.

In terms of sovereign ratings, majority of the GCC countries continued to boast an investment grade rating by the end of year with Abu Dhabi and Kuwait leading the pack. Recently, Oman's sovereign rating was downgraded by Fitch to a non-investment grade reflecting a widening of fiscal deficit to 10 percent of GDP in 2019 at an expected oil price of $65 per barrel, while the outlook for Bahrain was changed to Stable from negative.

US and MENA rate hikes

After a three rate hikes in 2017, the US Fed raised benchmark interest rates four times in 2018 and raised the rate by 100 basis points in four 25 bps steps to a higher range of 2.25 percent - 2.5 percent. Continued strong economic fundamentals in the US with expectations of a faster economic growth further backed by supportive employment and inflation data backed the rates hikes during 2018. However, expectations for 2019 was toned down while announcing the latest rate hikes with the committee now expecting two rate hikes in 2019 instead of a previous expectation of 3 hikes. The long-run funds rate expectations were also lowered from 3 percent in the September-18 forecast to 2.8 percent in the latest forecast. Expectations for 2019 were lowered to 2.9 percent from 3.1 percent while 2020 and 2021 estimates were lowered to 3.1 percent from 3.4 percent in the previous forecast.

Rate hikes within the GCC were more differentiated with central banks using different tools in response to US rate hikes. Kuwait's central bank kept its discount rate on hold after raising it in Q1-18 to 3.0 percent from 2.75 percent after holding it for a year. In response to the latest US rate hike, UAE central bank raised interest rates on certificates of deposit and repo rate for borrowing short-term liquidity by 25 bps. Bahrain's central bank also raised its one-week deposit facility rate, the overnight deposit rate and lending rate by 25 bps to 2.75 percent, 2.5 percent and 4.5 percent, respectively. Saudi Arabia also raised repo rate and reverse repo rates to by 25 bps to 300 bps and 250 bps, respectively.

Regional fixed income indices mostly had a positive trend during the year while global fixed income indices declined in 2018. Although marginal, the MENA Bonds and Sukuk index gained 0.4 percent during 2018 while the benchmarks for the Global Investment Grade Debt and Global Sukuk declined by 1.2 percent and 4.1 percent, respectively.

2018 performance

Bond issuances in the MENA region declined for the second consecutive year during 2018 led by a decline in issuances in both GCC and non-GCC MENA countries. In terms of type of issuer, government issuances declined by a quarter to reach $76.1 billion in 2018 while corporate issuances increased by 19.8 percent to $35.5 billion. Total bond issuance by GCC countries stood at $72.6 billion, down 10.9 percent as compared to $81.4 billion in 2017.

Qatar was the biggest issuer during the year with total issuances increasing by almost 300 percent to $26 billion in 2018 as compared to $6.8 billion during 2017. The increase came primarily on the back of higher government issuances that jumped by almost 400 percent to reach $16.6 billion in 2018 as compared to $3.5 billion in 2017. Corporate issuances in Qatar also increased by 180 percent to $9.4 billion in 2018, as compared to $3.4 billion in 2017. UAE was the second biggest issuer with $19.6 billion in total issuance during 2018, a steep decline from $31.3 billion in 2017. The decline in UAE came primarily as the government almost completely pulled out of the primary market with merely $0.3 billion in issuances during the year as compared to $10.0 billion during the previous year.

Corporates, on the other hand, remained active, but issuance declined by 9.5 percent to $19.3 billion in 2018 as compared to $21.3 billion during 2017. Saudi Arabia was the third biggest issuer in the GCC with $13.8 billion in new issuances in 2018 a marginal increase of 2.9 percent from 2017. Issuances from Oman increased by 40 percent y-o-y as both the government and corporates took the fixed income route to fund investments. On the non-GCC side, Lebanon was the third biggest issuer in the MENA region with issuances totaling $15.5 billion in 2018 a decline of almost a third as compared to $23.4 billion during 2017. Issuances by Egypt increased 7.2 percent to 13.5 billion, while Morocco issued $4.5 billion in bonds, a decline of 17.4 percent as compared to 2017.

The forecast for bond issuances in the GCC remains upbeat, given the budget requirements of governments in the region, as they continue to spend on infrastructure while oil prices remain below historical levels. Saudi Arabia has indicated that it would issue $32 billion in debt during 2019 in the international market to finance its budgeted deficits. Given the volatile equity markets and with oil price forecasted to remain subdued, we expect oil exporters in the GCC to increase bond issuances in 2019.

Corporate issuances has increased for three consecutive years and with the project market and economic activity in the region expected to pick up, we expect higher corporate issuances from the region.

After two consecutive years of growth in 2016 and 2017, global sukuk issuances declined by 21.6 percent during 2018 to reach $73.7 billion as compared to $93.7 billion during 2017. The steep decline came primarily on the back of a 20.8 percent decline in issuances from Malaysia recorded at $27.7 billion in 2018 as compared to $34.9 billion in 2017. The decline in sukuk issuances by Saudi Arabia was even higher at 35.1 percent or $10 billion, which drove the total lower to $8.6 billion in 2018 as compared to $28.6 billion in 2017. UAE was the only Islamic issuer to see more than doubling of sukuk issuances in 2018 that reached $8.6 billion as compared to $3.9 billion during the previous year.

Issuances within the GCC totaled $33.4 billion during 2018 as compared to $41.9 billion during 2017, a decline of 20.3 percent. In terms of type of issuers, global sovereigns continued to remain the biggest issuers of sukuk in 2018. However, sovereign issuances took a big hit in 2018 declining by almost a third to reach $45.2 billion as compared to $66.3 billion in 2017 led once again by relatively higher

oil prices until Sept-18 that lowered funding requirements. On the other hand, corporates issuers once again remained strong during the year with an increase of 4.2 percent in sukuk issuances that reached $28.5 billion in 2018 as compared to $27.4 billion in 2017. Also, as seen in the case of bond issuance, GCC corporates remained active in the market increasing total issuance by 21.4 percent in 2018 to $12.0 billion while GCC government sukuk issuances declined by 33.2 percent to $21.4 billion. On the sectoral front, Financials continued to grab the lion's share of total global sukuk issuances at $14.7 billion, flat as compared to the previous year. Utilities and Industrial companies were next issuing $5.9 billion and $3.8 billion in sukuks during 2018, respectively. Sukuk issuances in the MENA region is expected to pick-up in the near term given the increasing popularity of Islamic instruments with an

evolving and strengthening regulatory oversight and standardization. Moreover, regulators are also broadening the reach of sukuks to individual investors. For instance, Malaysia Securities Commission made it easier for retail investors to buy bonds and sukuk issued in the local market and has eased documentation requirements for issuers.

Similarly, Nasdaq Dubai is also planning to allow retail investors to invest in sukuk market in 2019 and introduce retail sukuk instruments with minimal investment limit and Shariah compliant interest rate. In addition, the inclusion of GCC economies in the global bond index would be positive for the sukuk market and would attract capital from international investors looking at taking exposure to higher rated sovereign sukuks.

KAMCO REPORT