Conventional banks grow at 2.3% rate, Islamic banks increase balance-sheet by 1.3%

KUWAIT: The GCC banking sector recorded one of the biggest growth in total assets during Q2-19 that reached $2.23 trillion. Sequential growth in assets during Q2-19 stood at 2.0 percent while the y-o-y growth was 6.4 percent, one of the highest over the pasts few quarters. The growth came primarily on the back of conventional banks that grew assets at 2.3 percent q-o-q while Islamic banks increased their balance sheet by 1.3 percent. The growth in earning assets was slightly lower at 1.3 percent to reach $1.86 trillion indicating a relatively higher growth in non-earning assets. The q-o-q growth in net loans stood at 0.9 percent in Q2-19 and reached $1.36 trillion after increasing at the more than double the pace during the previous quarter.

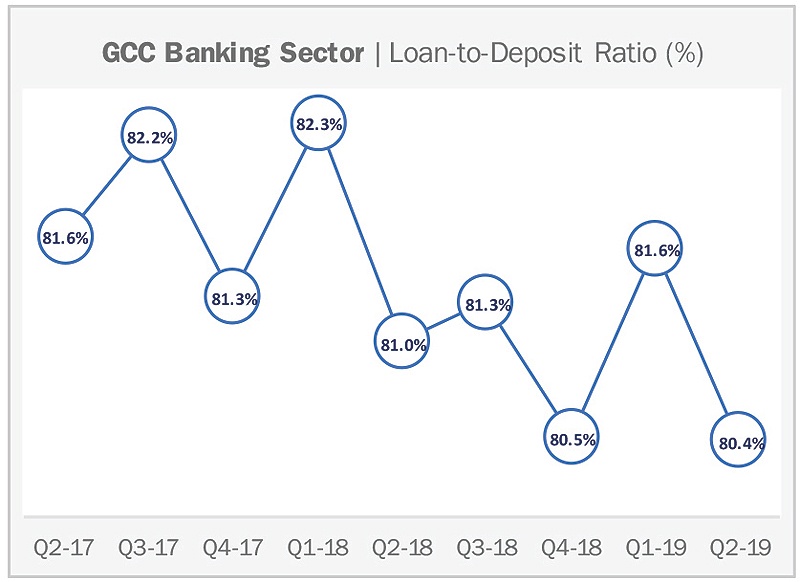

On the other hand, the growth in customer deposits was recorded at 2.3 percent q-o-q, the highest growth over the past eight quarters. As a result, the loan-to-deposit ratio reached 80.4 percent, one of the lowest over the last nine quarters and continued to remain well below international standards. The lower ratio shows underutilization of funds but at the same time indicates the extra capacity of GCC banks to fund future projects in the region and support the growth in private sector, especially the non-oil sector.

In terms of profitability, net interest income saw a marginal growth of 0.6 percent q-o-q to reach $14.3 billion during Q2-19 after witnessing marginal decline during Q1-19. On the other hand, non-interest income remained flat at $6.0 billion q-o-q resulting in a total bank revenue of $20.3 billion during Q2-19, a q-o-q growth of 0.5 percent. The relatively higher growth in earning assets as compared to net interest income resulted in a marginal decline in NIM from 3.16 percent in Q1-19 to 3.13 percent in Q2-19. In terms of operating expenses, cost optimization efforts by regional banks resulted in improved cost-to-income ratio that reached 37.1 percent, one of the lowest levels recorded for GCC banks. Nevertheless, an increase in provisions during the quarter resulted in a 5.1 percent q-o-q decline in net income, while y-o-y growth stood at a marginal 1.2 percent during Q2-19. The increase in provisions was primarily as a result of higher impairment charge reported by Saudi Arabian banks.

Saudi Arabia reported the highest NIM in the GCC at 3.7 percent as the Kingdom has shown consistent improvement in this key banking profitability ratio over the last ten quarters. The Kingdom has tightly aligned its key rate policy in line with US rates in order to maintain currency pegs. As a result of this, the increase in rates the US since last year were passed on by the Saudi central bank resulting in higher NIM.

This report analyzes financials reported by 62 listed banks in the GCC for Q2-19. The individual banking data has been aggregated to the country level as there are minimal differences in the countries' regulatory and supervisory environment. We believe that the charts and tables adequately capture the nature and structure of the individual countries' financial systems, their supervision and their monetary operations. Some of the key observations from the most recent financial for the GCC Banking Sector includes the following:

Total assets: UAE continues to lead

Total assets growth remained positive across the GCC resulting in one of the biggest quarterly growth during Q2-19. On the individual country front, UAE continues to boast the biggest share of total listed bank assets in the GCC recorded at $710 billion or 31.8 percent of the total GCC banking assets. UAE banks also recorded the biggest q-o-q asset growth of 2.9 percent in the GCC. The asset growth in UAE was also aided by the merger of privately held Al-Hilal Bank with ADCB and UNB bringing in its assets in the listed banks space. Saudi Arabia followed after UAE with total assets of $622 billion or 27.2 percent of the GCC at the end of Q2-19 after recording a q-o-q growth of 2.5 percent.

Among the listed banks in the Kingdom, only Banque Saudi Fransi reported a decline in assets during the quarter by 1.8 percent, whereas the remaining ten banks reported growth.

Loan-to-deposit ratio

The pace of growth in net loans declined to 0.9 percent in Q2-19. Banks in Oman, which reported the biggest sequential lending growth in Q1-19, posted the biggest drop in Q2-19 by 10.2 percent q-o-q. Four out of eight listed banks in Oman reported decline in lending with Bank Sohar (Sohar International) and Bank Nizwa reporting the biggest q-o-q drop. Net loans growth was the strongest in Bahrain at 2.5 percent followed by UAE and Kuwait at 2.1 percent and 1.9 percent, respectively. In terms of individual banks, 20 out of the 62 listed banks in the GCC reported a decline in net loans during the quarter. In UAE, National Bank of Fujairah reported the biggest growth in loans at 6.6 percent while bigger banks FAB and ADCB reported growth rates of 4 percent (adjusted) and 2.7 percent, respectively, ENBD's net loans were flat at $91.2 billion.

Meanwhile, in Kuwait, only KFH reported a decline in net loans by 1 percent, whereas smaller banks outperformed with Warba Bank growing its loan portfolio by 10 percent and KIB adding 6.5 percent during the quarter. NBK's loan growth was marginal at 1.4 percent. GCC listed bank's customer deposits growth remained positive across the board. As a result, the growth was the fastest in the last ten quarters at 2.3 percent, as compared to a growth of 0.6 percent in the previous quarter, to reach $1.68 trillion. Saudi Arabian banks reported the biggest increase in deposits at 3.3 percent followed by UAE and Kuwait at 2.8 percent and 2.2 percent, respectively, while Qatari banks posted the slowest growth of 0.4 percent. All banks in Saudi Arabia, barring Banque Saudi Fransi, reported sequential growth in customer deposits during the quarter.

Alinma Bank reported the biggest growth in customer deposits at 8.9 percent followed by Bank Aljazira at 5.7 percent. NCB customer deposit growth was at a decent 4.3 percent q-o-q. In UAE, FAB reported the biggest growth in customer deposits adding 6.4 percent during the quarter to reach $105.4 billion.

The net effect of a faster growth in customer deposits relative to net loans for the GCC banks resulted in a decline in the loan-to-deposit ratio. Bahrain reported the lowest loan-to-deposit ratio during the quarter that went below the 70 percent mark to reach 69 percent followed by Kuwait at 73.1 percent. On the other hand, Omani banks reported the highest ratio of 97.4 percent followed by Qatari banks at 90.4 percent during Q2-19.

Total bank revenue

Revenue for listed GCC banks reached $20.3 billion in Q2-19 primarily on the back of higher net interest income while non-interest income remained almost flat at $6.0 billion. Net interest income growth was strongest in Qatar which recorded a q-o-q growth of 2.8 percent whereas most other countries recorded marginal growth. The aggregate for the Omani banks saw a decline of 1.0 percent during the quarter.

In Qatar, four out of the eight banks recorded a decline in net interest income during the quarter, however, QNB's 4.3 percent q-o-q growth further supported by 9.7 percent and 5.9 percent growth reported by CBQ and KHCB, respectively, more than offset the decline in aggregate net interest income during the quarter. Saudi Arabian banks reported flat net interest income as compared to the previous quarter after a decline in net interest income for SAMBA, SABB and Saudi Investment Bank were completely offset by higher net interest income reported by other banks in the Kingdom. The performance of banks in UAE were also mixed as growth in net interest income reported by FAB (+6 percent), Emirates Islamic Bank (+5.3 percent) and Commercial Bank of Dubai (+2.9 percent) was partially offset by declines reported primarily by ADCB (adjusted) and NBQ.

Net interest margin

After remaining stable for three consecutive quarters at 3.2 percent, NIM for the GCC listed banks declined marginally during Q2-19 and averaged at 3.1 percent. The decline came primarily on the back of higher earning assets that more than offset higher interest income led by higher average interest rates in the GCC. Saudi Arabia has consistently grown its NIMs over the past several quarters on the back of rising interest rates. The Kingdom reported the highest NIM in the region at 3.7 percent followed by UAE and Kuwait at 3.1 percent and 3.0 percent, respectively.

Qatar reported the smallest NIM during the quarter that stood at 2.6 percent. Out of the six regions, only Saudi Arabian and Omani banks reported q-o-q growth in NIM during Q2-19.

Cost-to-income ratio

Continued cost efficiency improvement measures implemented by GCC banks has resulted in a visible improvement in the sector's cost-to-income ratio. The ratio has consistently declined over the past several quarters for the aggregate GCC banking sector and stood at 37.1 percent during Q2-19 for the GCC. Qatar has consistently reported the most cost efficient model with a cost-to-income ratio of 31.4 percent during Q2-19 vs. 31.5 percent in Q1-19 and 34.1 percent in Q2-18. The impact of scale was clearly visible with smaller banks in Bahrain and Oman reporting a significantly higher cost-to-income ratio of 48.2 percent and 47.4 percent, respectively.

Loan loss provision

Quarterly loan loss provision (LLP) witnessed a steep surge in the aggregate GCC banking sector reaching $3.1 billion during Q2-19 as compared to $2.4 billion during Q1-19. LLP increased across the board for all the GCC markets with Saudi Arabia witnessing the biggest increase in the GCC of 115 percent q-o-q to reach $1.2 billion during Q2-19. In Saudi Arabia, almost all the banks witnessed double digit growth in LLP barring Bank Aljazira that reported a q-o-q decline. Kuwaiti banks reported the second biggest increase in quarterly LLP during Q2-19 that surged 21.2 percent.

KAMCO GCC Banking Sector Report