IEA revises down its projection for global oil demand growth again

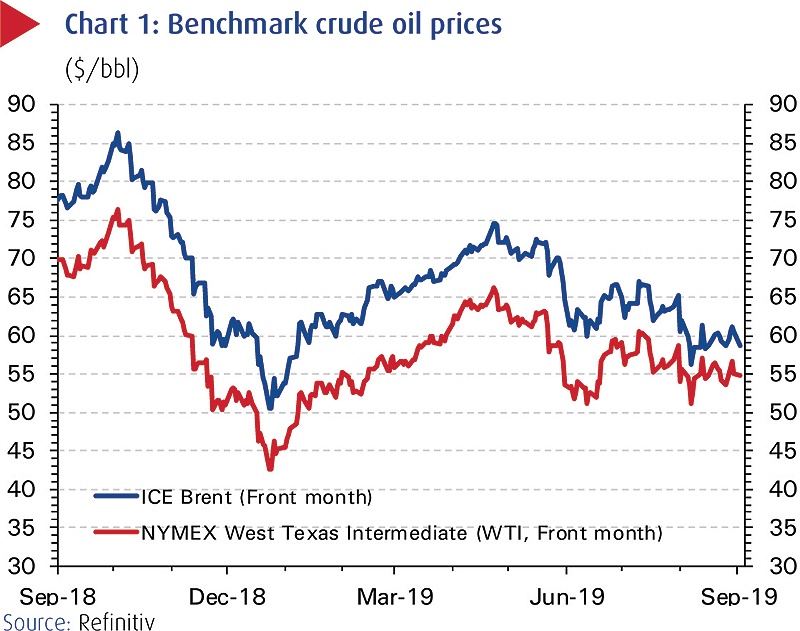

KUWAIT: Worries over the global economy continue to weigh on oil prices. Brent crude, the international benchmark, fell 7.3 percent in August to close at $60.4/bbl, the steepest monthly fall since May's decline of 11.4 percent. It has since dropped further, to around $58.3/bbl as of 3 September. The US crude marker, West Texas Intermediate (WTI), declined 6 percent in August to $55.1/bbl. Brent though returning a decent 8 percent year-to-date, has, nevertheless, lost almost 22 percent of its value since its 2019-peak in April.

The current US administration's recourse to trade protectionism, engaging in escalating rounds of tit-for-tat tariffs with China has been significantly bearish for global economic growth, oil demand and, by extension, oil prices. The latest retaliation has seen China impose tariffs of up to 10 percent on $75 billion worth of US goods including soy beans and oil (5 percent). China was the largest importer of US crude during the first half of 2018, taking in about 376 kb/d on average, but has since scaled back its purchases by more than 60 percent in 2019 as the trade war has deepened.

The weakening economic backdrop has led the International Energy Agency (IEA) to revise down in August its projection for global oil demand growth in 2019 for a third time this year, by 100 kb/d to 1.1 mb/d. Demand growth is, however, expected to accelerate during the second half of 2019, spurred on by increases in gasoline and jet fuels consumption as well as petrochemicals production.

While rising demand would be expected to be positive for oil prices, the outlook is complicated by the continued global stock overhang and by surging US shale production. OECD commercial crude stocks increased counter-seasonally in June to 2,961 mb, 66.9 mb/d above the five-year average for that month. Reducing global crude stocks is one of the targets that OPEC+ has been working towards, but which, after three consecutive months of increases, appears to be slipping further away. US crude production, meanwhile, continues to break records. In late August, output reached 12.5 mb/d on gains of 800 kb/d in 2019 alone.

This has made OPEC+ efforts to clear away the supply surplus more difficult since this figure offsets almost half of the aggregate production (1.7 mb/d) that OPEC+ has pared back as part of the group's Vienna production cut accord that went into effect in January. And this has occurred in spite of OPEC+ regularly notching up commendable compliance rates in excess of 100 percent (141 percent in July). OPEC's own output is down at around a five-year low of 29.6 mb/d thanks to steeper than mandated production cuts by Saudi Arabia, Angola and Kuwait as well as by continued, involuntary production declines in Iran and Venezuela as a result of sanctions. With the supply picture uncertain, it seems likely that for oil to regain some of its luster, progress in Sino-US trade talks needs to occur as a minimum.

NBK ECONOMIC REPORT