KUWAIT: National Bank of Kuwait (NBK) always seeks to enhance its digital services provided customers via the NBK Mobile Banking App. In this context, the bank announced introducing Instant Payment Service (WAMD) through the app starting from 30th of June 2024, for smooth and hassle-free money transfers. The service comes within K-Net’s implementation of a new domestic account to account instant payments scheme in Kuwait under the authority and supervision of the Central Bank of Kuwait (CBK).

The instant payments system (WAMD) provides added value and quality to the national payment infrastructure capabilities. It also serves as a safe and advanced payment option that caters to the needs of different customer segments, while advancing digital transformation in Kuwait by increasing the volume of electronic financial transactions. By introducing this service on its Mobile Banking App, NBK aims to gain a high level of performance for more customer satisfaction, as well as providing a reliable and secured service (users need a verification code during registration to the service).

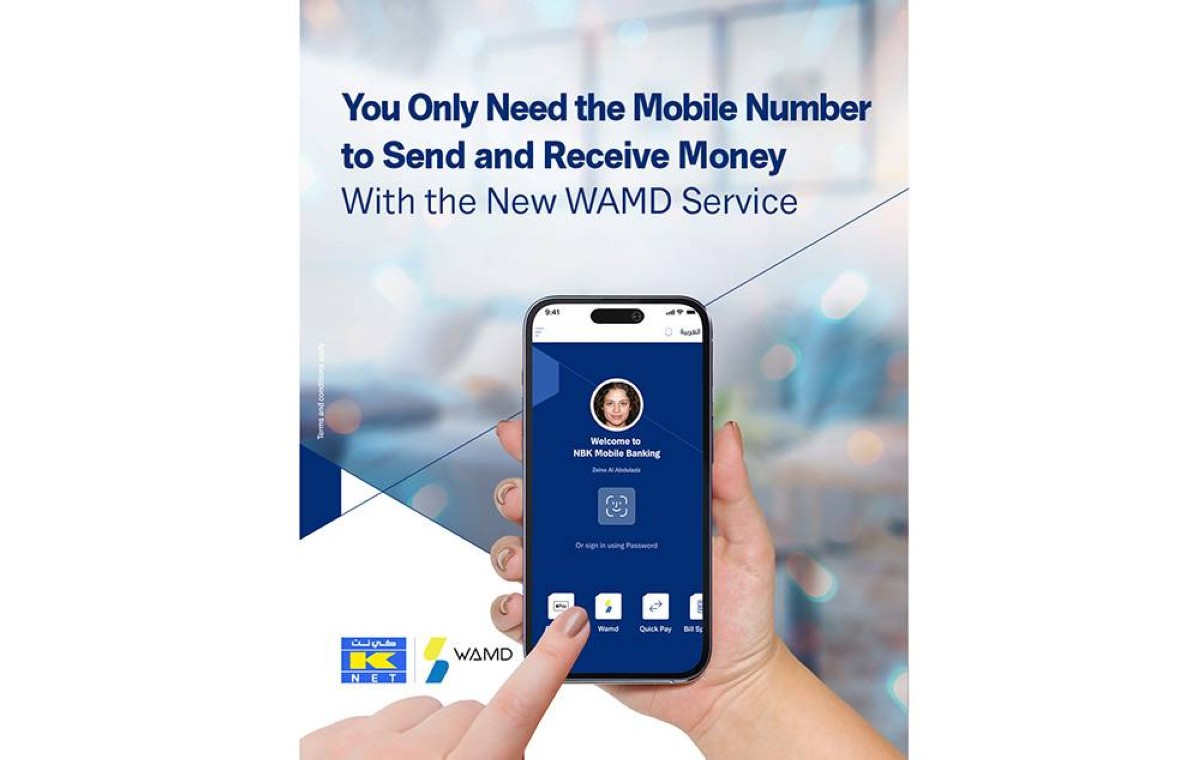

The instant payment service to be provided on the NBK Mobile Banking App offers an easy way to transfer money as all customers need is a valid mobile number of the beneficiary to send the money. It also provides straightforward transactions, as customers need to input the beneficiary’s mobile number, transfer amount, purpose, as well as any other notes, and agree to the terms and conditions before executing the transaction. To avail the WAMD service via the NBK Mobile Banking App, customer needs to register to the service and link one bank account with it, to be able to send, receive and request money.

Commenting on service launch, Abdullah Al-Mutawa, Head of Funds Transfer & Wealth Management Operations at National Bank of Kuwait said: "NBK is a trailblazer in adopting the most advanced services that bolster its leadership in providing the latest digital banking solutions in instant payments in Kuwait.”

"We make unwavering efforts to keep pace with customers’ ever-evolving needs and to live up to their growing expectations. We also strive to meet their preferences within our commitment to provide top-notch and highly advanced products and services,” he added. Through the NBK Mobile Banking App, NBK aims to offer customers a secure platform to conveniently manage their finances at any given moment. This service facilitates a wide range of banking activities, including opening new accounts, monitoring transactions on accounts and credit cards, accessing accumulated NBK Miles and NBK Rewards Program points, settling credit card dues, making payments for electronic bills, locating the nearest NBK Branches, ATMs, and CDMs across Kuwait, submitting requests for account statements, updating personal information, as well as toll-free numbers to call when they are abroad to reach the bank for any help/inquiry. Customers can easily download the NBK Mobile Banking App, which is currently available on various platforms including the App Store, Google Play, and Huawei AppGallery.

NBK is a trailblazer in providing advanced solutions that bolster its leadership in the payment area