KUWAIT: ALAFCO closed a USD 470 million 5-year unsecured Murabaha facility on 24th June 2019. The financing facility was led by Al Ahli Bank of Kuwait - DIFC Branch, which is regulated by the Dubai Financial Services Authority, and HSBC Bank Middle East Limited in the capacity of Initial Mandated Lead Arranger and Joint Bookrunners.

HSBC has also played the role of Coordinator in this transaction. Whilst Commercial Bank of Kuwait and National Bank of Bahrain acted as Joint Lead Arrangers; Warba Bank acted as Joint Lead Arranger, Joint Bookrunner and Investment Agent and First Abu Dhabi Bank PJSC acted as Global Agent and Facility Agent. The deal had participants from Kuwait, Bahrain, UAE and Korea. The facility was structured through an SPV formed in Abu Dhabi Global Market. Initially, there are eight banks participating in the deal and more banks are expected to join in the second tranche, which could increase the facility size up to USD 650 million, as the facility has an accordion feature.

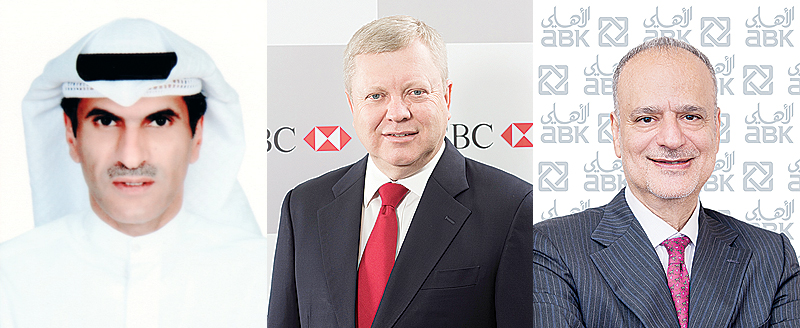

Michel Accad, Group CEO of Al Ahli Bank of Kuwait, Initial Mandated Lead Arranger and Joint Bookrunner, said: "We congratulate Alafco and the participating banks on achieving this strategic milestone, and for the timebound execution of this landmark transaction. For ABK it also underscores our regional capability in leading and arranging syndications in the regional structured loan market."

Roger Winfield, CEO of HSBC in Kuwait said: "HSBC is pleased to have acted as Sole Coordinator, Initial Mandated Lead Arranger and Joint Bookrunner for ALAFCO's landmark USD 470 million Murabaha facility. We look forward to continue supporting the company's growth, which is underpinned by its strong business model, management team and shareholders. Throughout Kuwait and the wider region, we are seeing an increasing demand for Islamic financing solutions, which we are well-placed to help meet given our regional heritage and international network."

Adel Ahmad Albanwan, Chief Executive Officer ALAFCO, said "We are delighted to have secured and concluded this landmark transaction and would like to thank all parties involved. This transaction demonstrates the belief and confidence our partners have in ALAFCO, and we welcome them as we seek to develop long-term strategic partnerships going forward.

Whilst we wholeheartedly appreciate the roles played by all the parties as part of this transaction, Warba Bank has continued to demonstrate their commitment to ALAFCO and we would like to extend our gratitude to them for their ongoing support. Warba Bank remains a strong partner for ALAFCO over recent times, notably the Bank was instrumental in closing our debut Unsecured Murabaha facility in 2017.

This deal marks the forging of new relationships and consolidation of existing ones. We thank our existing international partners; Korean Development Bank, HSBC and Mashreq Bank for their continued support. Additionally, the role played by Al Ahli Bank of Kuwait, Commercial Bank of Kuwait, National Bank of Bahrain, Gulf Bank and First Abu Dhabi Bank has been pivotal. These institutions represent the establishment of new partnerships for our firm and we would like to thank them for the confidence they have shown in ALAFCO. We look forward to working closely with all our partners, seeking to further strengthen our working relationships into the future".